If the Fed cuts interest rates this week, how will your finances be impacted?

Interest rates are expected to drop for the first time in four years this week, but don’t expect that to be life-changing, experts said.

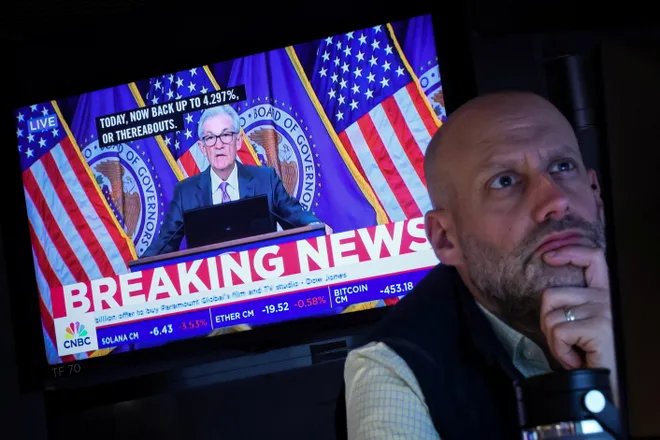

When the Federal Reserve concludes its policy meeting Wednesday, almost all economists expect the Fed will lower its benchmark, short-term federal funds rate. However, whether the decrease will be by a quarter- or a half-percentage point from its 23-year high of 5.25 to 5.50% is basically a coin toss.

Either way, consumers shouldn’t expect to see much immediate difference, analysts said. Financial institutions are usually slow to lower the rates they charge borrowers when the Fed begins to cut its own rate, but quick to slice rates they pay on savings vehicles like certificates of deposit and savings accounts.

“While lower rates are certainly a good thing for those struggling with debt, the truth is that this one rate cut isn’t really going to make much of a difference for most people,” said Matt Schulz, credit analyst at online marketplace LendingTree. “It doesn’t change the fact that the best thing people can do to lower interest rates is to take matters into their own hands.”

Greg McBride, chief financial analyst at comparison site Bankrate, said "what will be more significant is the cumulative effect of a series of interest rate cuts over time.”

Earn rewards on your spending: See the best credit cards

Will credit card rates drop?

Yes, rates will “almost certainly fall from record highs in coming months, (but) no one should expect dramatically reduced credit card bills anytime soon,” said Schulz.

For example, September’s average new credit card rate was 24.92%, unchanged from August and the highest since 2019 when LendingTree began tracking this data. If you have $5,000 of credit card debt at a 24.92% APR and paying $250 per month, it’ll take you 27 months and $1,528 in interest to pay the balance off.

- If the APR drops a quarter point to 24.67%, it’ll still take 27 months but $1,506 in interest to pay off the debt. That’s a savings of $22 over 27 months, less than a dollar a month.

- A half-point decline in the APR to 24.42% will take 26 months and $1,485 in interest to pay off your bill. That’s a savings of one month of payoff time and $43 in interest, or about $1.50 per month.

Daniel Milan, managing partner at advisory firm Cornerstone Financial Services, also said financial institutions aren’t necessarily tying their annual percentage rate for credit cards on what the Fed does.

“They’re pegging their rates to their own risk,” Milan said. “If credit risk is increasing -- balances are up, defaults are up, and savings are down, then we could see (Fed) rates go down and APR go up or stay about the same because (banks) are inputting different data.”

Credit card debt rose to a record $1.14 trillion between April-June, 9.1% of credit card balances became delinquent over the past year and personal savings rates are near a two-year low, government data shows.

Instead of banking on lower rates to help with credit card debt, consumers should consider consolidating debts with a 0% balance transfer credit card or a low interest personal loan, experts said.

Will auto loans get cheaper?

Auto loan rates will likely ease but again, don’t expect a sharply lower interest rate, analysts said.

“A Fed rate cut wouldn’t necessarily drive all those consumers back into showrooms right away, but it would certainly help nudge holdout car buyers back into more of a spending mood,” said Jessica Caldwell, head of insights at car comparison site Edmunds.

According to an Edmunds survey in August, 64% of all car shoppers said a Fed rate cut would affect the timing of their next car purchase. However, vehicle costs are still significantly elevated.

“At the end of the day, shoppers need to be approved for loans as the first step and then successfully pay their monthly payments to stay in their vehicle,” said Jessica Caldwell, Edmunds’ head of insights.

Will buying a home become more affordable?

The Fed doesn't directly set mortgage rates, but they generally follow the same trajectory.

In the meantime, they’ll continue to fluctuate on a week-to-week basis based on bond market gyrations and inflation data, which follows recent trends. Freddie Mac’s 30-year, fixed-rate mortgage average was last at 6.20%, lower than the 7.22% average reported on May 2, even as the Fed’s kept rates steady.

The 30-year, fixed mortgage rate’s likely to linger between 6% to 6.5% in coming weeks and maybe dip below 6%, said Jacob Channel, LendingTree’s senior economist.

“Nonetheless (mortgage rates) remain relatively high compared to where they stood through most of the last decade,” he said. “What’s more, home prices remain at or near record highs in many areas.”

Jared Chase, financial adviser at Signature Estate & Investment Advisors, said “just because rates are pushing lower, that doesn’t help the sticker price.”

How will savers be affected?

People who’ve enjoyed collecting steady, near-riskless money from multidecade high interest rates will likely see an almost immediate decline in savings and CD yields, experts said.

“Savings rates have already started to fall and will continue to do so, but there’s no need to panic,” Schulz said. “Yes, if you haven’t opened a high-yield savings account or locked in a rate on a CD yet, you’ve likely already missed the rate peak. However, it can still definitely be worth your time to make either of those moves now before rates fall even further.”

Even with lower rates ahead, “savers seeking out the most competitive offers will remain well ahead of inflation for the foreseeable future,” said Greg McBride, chief financial analyst at comparison site Bankrate.

If savers are hesitant to lock up their money for longer terms, Daniel Milan, managing partner at advisory firm Cornerstone Financial Services, said they can move their money into high quality, dividend growth stocks instead.

“Dividend growth is key,” he said, recommending companies that grow their dividends by 7-10% annually to beat inflation.

Economy wrap:Where will the Fed land on interest rate decision? Here's where the economy stands.

What will happen with the stock market?

The stock market’s already been gaining in anticipation of lower rates. Lower rates usually boost stocks because companies can borrow at a lower cost to invest in and grow their businesses.

The broad Standard & Poor’s 500 index scored its best week of the year last week, and the blue-chip Dow touched a record high during Monday’s trading session.

In the most recent rally, investors have expanded their buying. Instead of just buying the so-called Magnificent Seven stocks of Apple, Amazon, Alphabet, Meta, Tesla, Microsoft and Nvidia, they’re snatching up high-quality dividend utilities, health care, real estate and consumer staples stocks, Milan said.

“This expanded breadth from early July is good, healthy for the market,” he said.

Medora Lee is a money, markets, and personal finance reporter at USA TODAY. You can reach her at mjlee@usatoday.com and subscribe to our free Daily Money newsletter for personal finance tips and business news every Monday through Friday morning.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.