Using AI to buy your home? These companies think it's time you should.

The way Americans buy homes is changing dramatically.

New industry rules about how home buyers' real estate agents get paid are prompting a reckoning among housing experts and the tech sector. Many house hunters who are already stretched thin by record-high home prices and closing costs must now decide whether, and how much, to pay an agent.

More:As new real estate agent rule goes into effect, will buyers and sellers see impact?

A 2-3% commission on the median home price of $416,700 could be well over $10,000, and in a world where consumers are accustomed to using technology for everything from taxes to tickets, many entrepreneurs see an opportunity to automate away the middleman, even as some consumer advocates say not so fast.

The tech-enabled AI upstarts

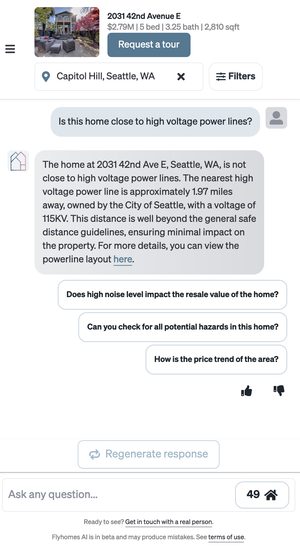

The home search function at Flyhomes, a Seattle-based real estate tech company that bills itself as “the world’s first AI-powered home search,” has been up and running since June.

Buy that dream house: See the best mortgage lenders

“The way that we designed this is really to be almost like you're talking to a local real estate agent, and to be able to answer not all the questions because it's not a human, but maybe 80% of the questions,” said Adam Hopson, the company’s chief strategy officer.

Additionally, Hopson said, some questions that a human agent might have to research – when were permits last pulled on the home, how close are the nearest power lines – are now readily at hand, thanks to the reams of data the Flyhomes team has programmed into the tool.

AI is also available when house hunters are most likely to be browsing, he said: late at night, on the weekend, or other times when a human might be unable to answer a question. Raffi Isanians, the cofounder and CEO of Modern Realty, which calls itself an "AI Realtor for Home Buyers," believes the search part of the process is secondary. Consumers care most about having a human agent help with pricing strategy and negotiations, he said, and Modern has built its model accordingly.

“What we do is by naturally automating a lot of the other stuff, what we can do is we can have agents be very, very good at those two things,” Isanians said. “So they’re like master negotiators. Like your real estate agent does this five times a year? Ours did this five times today before lunch.”

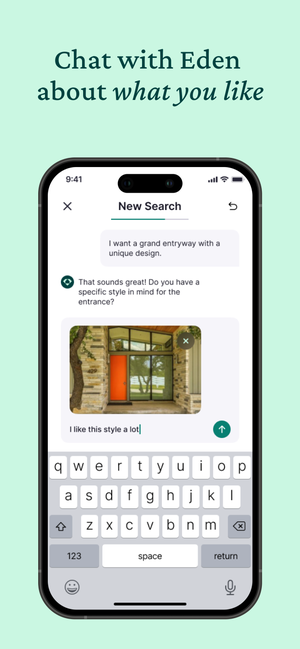

Eden, a young company in Austin, also provides agent services “as needed,” with buyers paying only for the services they use. Experienced agents draft buyers’ offers for free, but negotiation and closing help cost a few hundred dollars.

But Eden’s founders believe that within five years, “every aspect of the buyer agent role will be automated with AI,” co-founder Luke Mizell told USA TODAY in an email. "We believe the potential for AI in real estate is being vastly underestimated. Soon, Siri will integrate with ChatGPT, and consumers will become accustomed to speaking to AI for everything. In five years, AI will answer all your questions, write your offer, negotiate on your behalf, and even track when your home appliances need updates—all at no cost.”

Artificial intelligence... or augmented?

Whatever may evolve, for now, it makes sense that even the more innovative tools still rely on humans for certain parts of the process, said Brooke Anderson-Tompkins, the founder and CEO of bridgeAIvisory, a consultancy.

Tompkins pivoted into AI strategy after spending several decades running mortgage lending companies. As excited as she is about the potential for artificial intelligence to remake industries, Tompkins said, what we see now is augmented intelligence, with humans and machines “co-piloting” processes. And that’s okay.

In such a weighty transaction, where so much is dependent on people and processes, “the true value of what an agent puts on the table will not likely be crazy apparent until something doesn't go the way you think it should. And when it doesn't, you need a subject matter expert that has local knowledge and connections,” Tompkins said in an interview.

If buyers want to avoid paying an agent, one way to get the human touch in the equation might be to work with a trained housing counselor, or attend a first-time homebuyer class, said Sharon Cornelissen, director of housing at the Consumer Federation of America.

Cornelissen also cautions consumers to be on the lookout for “hallucinations” from artificial or augmented intelligence tools. Hallucinations refer to the tendency of AI models to offer incorrect or misleading information in response to human queries.

“Buying a home is the largest purchase that most consumers make in their life,” Cornelissen said. “You don’t want to rely on false information when making such an important decision.”

Consumers should also find out how their personal information will be used by the systems, Tompkins said. The amount of personal and financial information used to buy a home, from bank statements to credit scores and social security numbers, makes this a critical question.

Still, for a generation that's grown up on the web, trusting a bot with such personal details may be second nature. Millennials "look on the internet," Isanian said, and ask, "are there any alternatives? And that's where we come in."

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.