Biden's SAVE plan for student loan repayment may seem confusing. Here's how to use it.

David Edwards, 31, heard all the buzz about signing up for President Joe Biden's SAVE program to significantly cut his student loan bill each month. And even in light of all the hype, the Wayne State University graduate in Michigan decided against it.

An English teacher who doesn't avoid math, Edwards ran his own numbers for dealing with roughly $21,000 in student loan debt still on his plate. He decided to look at the SAVE plan after he spotted an email in his inbox from the U.S. Department of Education. More than 30 million borrowers received information from the Education Department and their loan servicers inviting them to sign up for the new income-driven Saving on a Valuable Education Plan.

The SAVE plan offers the lowest monthly payments of any income-driven repayment plan out there — even triggering a $0-a-month payment for those living on limited budgets. Payments are based on the borrower's income and family size.

Borrowers already on the old Revised Pay As You Earn or the REPAYE Plan, will be put on the SAVE Plan automatically; they won't need to sign up. SAVE replaces REPAYE.

Unfortunately, the SAVE plan is so new — and potentially confusing — that some student loan borrowers might rule it out when they shouldn't if they only read a few Tweets or talk with friends. No one-size-fits-all answer exists.

Learn more: Best personal loans

How to find out more about the Biden student loan SAVE plan

"Most borrowers will see their payments lowered by the SAVE plan, but every borrower needs to understand and use the online calculators to make sure moving into that plan is best for them," said Scott Buchanan, the executive director of Student Loan Servicing Alliance, an industry trade group.

An online loan simulator at StudentAid.gov/loan-simulator can help you review your options. See StudentAid.gov/save to study the details relating to the SAVE plan.

The new SAVE program, Buchanan said, provides a huge taxpayer subsidy for many borrowers, but added: "Don’t assume it’s financially best for everyone."

SAVE is not a slam dunk, and might not be good for you if you've got graduate school debt or you're likely to end up in a dramatically higher-paying job soon. Or your income is relatively high already and your student debt load is pretty low.

SAVE is a game changer, however, if you already live paycheck-to-paycheck; you've got a family or have a lower-paying job and are fearful that you won't be able to cover a $300 or $400 student loan bill each month — or one that's even higher — once payments resume in October.

How do you get a $0 student loan payment?

Some who make $15 an hour now could owe nothing each month under SAVE. Your monthly payment is based on your discretionary income — the difference between your adjusted gross income and 225% of the poverty line for your family size, up from the 150% guideline used in other repayment plans. The objective is to protect a minimum amount of income to ensure that borrowers can cover basic necessities like food and housing costs.

As a result, SAVE offers more families smaller student loan payments. "This means a family of four who had to earn roughly $45,000 or less to qualify for $0 a month payments could now earn as much as $67,500 for $0 payments," said Andy Manthei, an associate business development representative for Farmington Hills-based GreenPath Financial Wellness.

Plus, the $0 payment is still building credit toward loan forgiveness.

The good news: While the Education Department has encouraged early sign-up to deal with the restart of loan payments in October, there's no real deadline. You can sign up later.

SAVE offers benefits now— but also adds attractive benefits next July, which likely aren't understood by many borrowers.

The first step

Know what you owe when your student loan bills resume if you don't make any changes. You can find that information through your StudentAid.gov account.

Many student loan bills should start arriving as early as mid-September. Billing statements are to arrive at least 21 days before your payment is due in October. It's good to update your account at StudentAid.gov and make sure your servicer can find you, especially if your servicer changed.

Next step

Know what kind of payment plan you're in now. Just because you can afford a $150 payment doesn't mean you're in a repayment plan that will save you money in the long run. You might be in a graduated repayment that starts off with a monthly payment that covers mostly interest and then is set to automatically go up every two years. Depending on the amount you owe, such payment plans can extend from 20 years to 30 years.

Payment plan:Best way to pay off student loans? Prepare. Here's what you should (and shouldn't) do.

What Edwards saw when he researched the SAVE plan

Edwards owes $334.31 a month beginning with his first restart payment due Oct. 5. He's on the standard 10-year repayment plan.

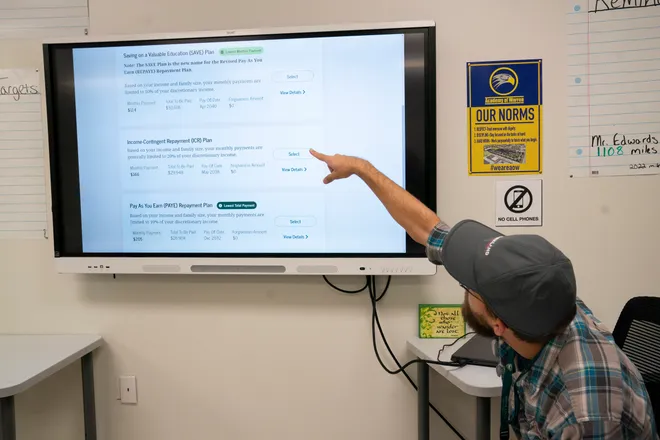

To figure out if SAVE might be a better deal for him, Edwards turned to the online simulator at StudentAid.gov and then directly imported his tax information from 2022 when his adjusted gross income was $46,520 that year. It didn't take long to see his numbers.

They were:

- $114 a month under SAVE when monthly payments are 10% of discretionary income. Under the SAVE plan, the payoff date is April 2040. Total to be paid: $32,618.

- $166 a month if he signed up for an income-contingent repayment plan, based on income and family size. This plan limits monthly payments to the lesser of the following: 20% of discretionary income or what you would pay with a fixed payment over 12 years. Under that plan, Edwards’ payoff date is May 2038. Total to be paid: $29,948. Others could see the remaining debt forgiven after 25 years of payments.

- $205 a month under the Pay As You Earn — or PAYE plan — that limits monthly payments to 10% of his discretionary income. Under that plan, the payoff date is December 2032. Total to be paid: $26,904. Others could see the remaining debt forgiven after 20 years of payments.

The SAVE plan clearly would free up more cash each month. His monthly payment would be about $220 a month lower under SAVE, compared with what he owes now.

While many would opt to sign up for SAVE to cut monthly payments by nearly two-thirds, Edwards isn't jumping at the chance. He fears that he'd owe more in interest in the long run — and the numbers online suggest that, too, in his case.

Edwards thinks he will stick with what he has now. Edwards, who is not married and doesn't have children, thinks he can cover it.

He also has the financial advantage of being able to live at home with his parents in St. Clair Shores, Michigan, rent-free. "I'm one of those millennials," Edwards said with a smile.

How public service loan forgiveness could help

For Edwards, the SAVE plan would have been a clear winner if as a teacher he qualified for public service loan forgiveness and saw his remaining debt forgiven after he made payments for another three years or so, said Mark Kantrowitz, a student loan expert and author. Public service loan forgiveness can take place after 10 years of repayments under an accepted repayment plan for qualified borrowers who work full-time for an eligible government or nonprofit employer.

But Edwards researched that, and his charter school is a for-profit school. The Education Department website says he does not qualify for public service loan forgiveness through that employer.

Kantrowitz noted that borrowers who are pursuing public service loan forgiveness are in a unique situation after the COVID-19 payment pause.

Take a borrower who made three years of payments toward public service loan forgiveness before the payment pause hit in 2020. That borrower would then get credit toward loan forgiveness for another 3½ years of payments during the payment pause — even though no money was paid then. With 6½ years credited, Kantrowitz said, that borrower would have only 3½ years of making payments left before the remaining debt is forgiven.

Without public service loan forgiveness, Kantrowitz said, it seems like a safe bet that Edwards stick with paying $334.31 a month if he can afford it. Other possible twists exist, too.

Of course, Edwards' situation could change. Now, he is able to avoid paying rent. But what if he wants to move into an apartment and needs to start paying rent of $1,000 or more a month?

"Every person’s situation — and goals — are different," said Manthei, of GreenPath.

Someone who does seasonal work — or doesn't have a steady paycheck — might want to sign up for the SAVE plan to keep payments low, Manthei said. If their situation improves, they could add money to the principal to pay down the debt more quickly.

What the Education Department calculator doesn't say

And there's another key twist. The SAVE plan is going to undergo two important changes in July 2024 that would reduce both monthly and lifetime payments significantly for those with only undergraduate debt.

The online simulator didn't spell that out for Edwards — so it's not likely to be obvious.

First, the plan is to cut monthly payments on undergraduate loans — and all of Edwards' loans are undergraduate —essentially in half beginning in July 2024. The Education Department notes that payments on undergraduate loans will be reduced from 10% to 5% of discretionary income when the SAVE plan is fully implemented next July.

Also, those borrowers who have undergraduate and graduate loans in the mix will pay a weighted average of between 5% and 10% of their discretionary income based on the original principal balances of their loans.

Based on the same income level, Edwards would see his payment drop to $57 a month next year from the $114 listed online at the calculator, Kantrowitz noted. As a result, SAVE could be far more beneficial and actually save more money for Edwards in the long run, too, Kantrowitz said, especially if he only sees modest raises in the years ahead.

For borrowers with undergraduate loans only, the maximum time for forgiveness is 20 years of qualifying payments.

How much payments change each year and add up over 20 years would depend on one's income and it's tricky to project into the future. But if payments ended up being roughly $87 a month or less over 20 years, Edwards would pay less than he would under a standard 10-year repayment.

"It will even be lower than the $21,000 he owes now," Kantrowitz said, adding: that "5% vs. 10% makes a big difference, so it is perturbing that the U.S. Department of Education calculator doesn't reflect this."

But Buchanan offered one possible explanation, saying that generally, online calculators don’t make assumptions about the future rollout of regulatory changes before they actually happen. "They reflect what is true and available today," Buchanan said. "It’s possible that the rollout of the other components could get delayed or tied up in litigation."

The Education Department notes online that its loan simulator should not be considered financial advice.

A key change for loan forgiveness ahead

A second important change beginning in July 2024 involves loan forgiveness. Under the SAVE plan, borrowers will see their loan balances forgiven after 10 years of repayments, instead of 20 years, if they had original loan balances of $12,000 or less.

Even borrowers with slightly higher balances win. The maximum repayment period before the remaining debt is canceled rises by one year for every additional $1,000 borrowed. Loan forgiveness could happen in 12 years, for example, if your original principal balance was $14,000.

"Payments made previously (before 2024) and those made from now on will count toward these maximum forgiveness timeframes," the Education Department notes online.

The department estimates that this reform will allow nearly all community college borrowers to be debt-free within 10 years.

Why your career path can influence SAVE payments

Every 12 months, you need to recertify your income; and your monthly payment can change in future years. Beginning next July, the Education Department notes, an automatic recertification process will be available if you apply for income-driven repayment electronically in August 2023 or later and you agree to securely share your tax information.

"Part of the challenge of all income-driven repayment plans is that knowing today what plan is best depends upon projecting what future career and earning power looks like in the coming years," said Buchanan.

Borrowers might want to talk with loan servicers or seek outside direction from nonprofits, such as GreenPath.

What are some advantages of the SAVE plan?

Loan balances don't grow: Unlike making only the minimum payment on a credit card, you're not digging a deeper hole with SAVE. If you make your monthly payment, your loan balance won’t grow due to unpaid interest.

Say $50 of interest accumulates on your student loans each month but, based on your income and family size, you're only required to make a $30 monthly payment under SAVE. The extra $20 a month in interest each month in this example wouldn't be added to your loan balance, instead, it would be canceled by the Education Department.

It's a very unique twist in the income-driven repayment plans — and one that frankly could have saved much heartache for a lot of borrowers if it had been in place under earlier programs.

The $0 monthly payment: Scott Thompson, CEO of Tuition.io, a California-based platform for employee student loan contributions, said many borrowers might not realize that if they had a low income in 2022 -- say if they weren't working much or just started in their field -- they could qualify for $0 monthly payments for 12 months under SAVE.

Thompson noted that if someone didn't work in 2022 -- and then maybe was hired in May or June this year -- they still might qualify for another 12 months of $0 monthly payments next year.

No doubt, the SAVE calculation can be simple for some and harder for others.

Again, Edwards would have to review his numbers and consider what a $57 payment might mean to him next year and what he might pay in future years.

Edwards, who graduated in December 2016, has been on a 10-year repayment plan since 2017. He will owe student loan payments until 2030 -- not 2027 -- as a result of the payment pause.

Think of his loans as being put in hibernation. The principal balance, if no payments were made, is the same as it was before the pandemic. As a result, Kantrowitz said, a borrower on a standard 10-year plan who had made three years of payments before the 2020 pause will need to make seven years of payments when repayment restarts this year. Payments made during the pandemic count toward forgiveness.

Edwards paid about $10,000 on his loans for a while during the payment pause that began in March 2020 but he requested, as was allowed, a refund when it seemed likely that he'd qualify for Biden's widespread loan forgiveness plan.

The refund wasn't spent and, while he'd rather use it toward a down payment on a house, he says he plans to tap into it for student loan bills now.

On June 30, the U.S. Supreme Court blocked Biden's plan to forgive up to $10,000 in student loans for many borrowers and up to $20,000 in student loans for borrowers who had Pell Grants in college.

Edwards says he would have qualified for the $20,000 in forgiveness -- which would have erased most of his debt. He likely would have shopped for a home and helped his brother some with his student debt, which wasn't going to be forgiven.

Some 26 million people already had applied for or were automatically eligible for one-time student loan debt relief, including 864,000 people in Michigan, according to a White House fact sheet issued in January.

Like many borrowers, Edwards said he was disheartened and angry when he lost an opportunity for $20,000 in loan forgiveness. But he's also thankful that he's living at home, working and able to address his situation and pay his bill in October.

Edwards —who now makes about $52,000 a year — estimates he's already paid off about $13,000 in student loans -- including $4,000 in interest.

Edwards has been taking his overall costs into account ever since he started college.

He attended Macomb County Community College after graduating from Lakeview High School in St. Clair Shores, where he ran cross country and track. Tuition was so reasonable then, he said, he covered those bills basically by working at Burger King.

Right now, his bills are modest, too. He has some low-cost hobbies, like running. On Aug. 31, a board in his classroom noted that Mr. Edwards ran 1,108 miles so far this year and 1,259 miles in 2022.

He realizes that many student loan borrowers owe more money, face far higher payments and have other expenses, like mortgages.

"I'm better off than a lot of people," he said.

Contact personal finance columnist Susan Tompor: stompor@freepress.com. Follow her on X@tompor.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.