UAW strike could cost US economy billions. Could it also push the nation into a recession?

It's anyone's guess how long a UAW strike could last or how deep the economic pain could be in Michigan and across the country. Such forecasts before a contract deadline really are just best guesses − much like trying to prognosticate the upcoming winter's total snow fall when the leaves on the trees haven't yet turned red. It can be tricky.

The UAW's march toward the contract deadline at 11:59 p.m. Thursday has been so shockingly off course from earlier contract talks in the auto industry that many don't know what path any potential strike by 146,000 U.S. autoworkers could take.

Predicting the overall economic impact could be even tougher if the UAW moves to run strategic walkouts. As reported in the Detroit Free Press late Tuesday, a UAW strike plan could involve a most unusual strategy for targeting only certain key plants at all three Detroit automakers and escalating strike activity at different factories as warranted in the days ahead.

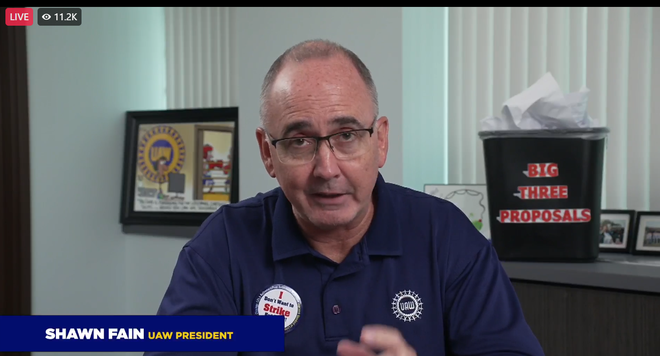

UAW President Shawn Fain is expected to outline the strike strategy to the broader union membership and public Wednesday evening during a Facebook Live event.

Provocative measures, such as these, make it harder to figure out how long any strike could last and when deep losses would be felt in the economy.

It's another twist in what's been an untraditional UAW contract season.

Sticking the words "Big Three Proposals" in bold red lettering across an ordinary black office trash can stuffed to the brim with white, crumbled paper − supposedly offers from the automakers that UAW leaders called insulting − proved to be a graphic moment in the string of videos made by Fain.

And hearing Fain talk about the possibility of taking out all of Detroit's three automakers − General Motors, Ford, and Stellantis − at once if an agreement isn't reached by Sept. 14 is an unprecedented, some might say unfathomable, scenario, according to auto industry experts. Typically, the UAW has successfully engaged in what's called "pattern bargaining" − targeting one employer first and then using that agreement to set a pattern and craft similar settlements with other automakers.

Fain is now "one of the most important people in the U.S. economy today," according to a CNN Business report, which also noted that "a year ago, almost no one knew who he was."

Could a long strike drive the U.S. economy − which has been chugging along fairly well − finally into the recession that has long been predicted but has yet to show up?

What does the UAW want?

Patrick L. Anderson, CEO of the East Lansing-based Anderson Economic Group, said the tone set by the UAW during these negotiations with automakers is quite a bit different than in the past.

Back in July, he noted, UAW president Fain refused to kick off contract talks with a traditional handshake with any auto executives. "I'm not shaking hands with any CEOs until they do right by our members, and we fix the broken status quo with the Big Three,” Fain said then during a Facebook Live address.

And then there was the wastebasket, Anderson said, "the trashing literally and figuratively of the bargaining proposals."

"All show a militancy and a willingness to characterize the company leadership in extremely negative terms," Anderson said, indicating a significant departure from past practices.

"Whether they strike or not − and against who − is a billion-dollar question," Anderson said.

"I don't know how much of this is rhetoric and performance and how much of it is grievance and motivation. And that may be part of the negotiating strategy of this particular UAW president."

What happens if UAW strikes?

A 10-day UAW strike against all three automakers at once − an unprecedented move where UAW members walk out at the same time at Ford, General Motors and Stellantis − could result in an economic loss nationwide of $5.6 billion, according to a forecast by East Lansing-based Anderson Economic Group. Here, the economics firm is estimating the potential losses to a slew of folks − UAW workers, the Detroit Three auto manufacturers, auto parts suppliers and others who face lost work and wages.

The Anderson Economic Group estimate −pinpoints total lost wages for autoworkers and others in a 10-day strike at $859 million. The loss doesn't take into account UAW strike pay which is now $500 a week. The lost wages estimate does include strikers and others who are temporarily laid off or who see their hours cut because of reduced production and demand.

Anderson told the Free Press that his firm's forecast doesn't include coffee shops, restaurants or retailers where those on strike or without work will likely stop spending money.

Striking all three automakers at once − while part of the bargaining threat − continues to raise eyebrows among outsiders, like Anderson and others.

"UAW President Shawn Fain has threatened to strike at all three, but the union's fund to pay striking workers will be depleted three times as quickly if he takes that path," said Erik Gordon, a clinical assistant professor at U-M's Ross School of Business.

Anderson called striking all three at once a "pretty serious threat" and said such a scenario still seems improbable.

"A strike against all three would be unprecedented," Anderson said, "and it would be an all-fronts war for the UAW. For southeastern Michigan, it would essentially shut down the auto industry in a way that didn't happen even in the long UAW strike against General Motors in 2019."

Yes, $5.6 billion is a big number − OK, it's shockingly huge − but it, too, is relative when you're talking about a U.S. economy that is larger than $25 trillion.

U.S. consumers are carrying a bit more − $1 trillion in debt − on their credit cards based on data for the second quarter, according to the Federal Reserve Bank of New York’s Center for Microeconomic Data. Outstanding student loan debt stood at $1.57 trillion.

U.S. wealth for households and nonprofits − which takes into account rising property values and rallying stock prices − hit a record $154.28 trillion in the second quarter, according to data released by the Federal Reserve on Sept. 8.

Again, it's all relative. And it's possible, depending on how long any strike lasts and any other economic hiccups, that the United States avoids a recession. Goldman Sachs on Sept. 4 put the odds at just 15% for the chance of a U.S. recession over the next 12 months.

Many industries bank on relationships with auto manufacturers and could feel some squeeze. Goldman Sachs issued a detailed report Monday examining potential scenarios for a strike's impact on freight railroads, concluding that there was enough diversity in shipments to weather a lull in autos and that auto-related demand would be "partly delayed rather than fully destroyed."

Michigan could face some of the biggest risks.

Anderson told the Free Press a lengthy strike would likely cause Michigan to go into a "one-quarter, one-state recession." He said Michigan saw such a downturn in 2019 after the six-week UAW strike at GM.

"If the union were to strike all three, rather than just one," Anderson said, "it would intensify the effects on suppliers who serve more than one automaker."

But, again, we don't know how long any strike might last or how far it could extend. Daily we're hearing of new developments, as we move closer to Thursday's deadline, which Fain has said is a hard deadline, not a suggestion.

Many in Michigan remain on edge about their jobs, their paychecks and the financial health of their neighbors, family and friends.

Surviving inflation:Scarred by two years of high inflation, this is how many Americans are surviving

High interest rates:High interest rates mean a boom for fixed-income investments, but taxes may be a buzzkill.

U.S. economy far different than in 2019

Some economists don't foreshadow a UAW strike throwing the country into a recession. But the reality is that some families who are already struggling to cope with higher prices for food and rent might not have much wiggle room in their budgets for the big cutbacks that a lengthy strike could bring.

It could be trickier to pay the bills − even at $500 a week in UAW strike pay, double the $250 that it was in September 2019.

Assuming the UAW strikes all three domestic automakers − Ford, GM and Stellantis − and the strike lasts say through the end of October, or roughly six weeks, the impact on the U.S. economy could be relatively mild, said Mark Zandi, chief economist for Moody's Analytics.

The annualized real growth in the nation's gross domestic product would likely be reduced by 0.2% in the fourth quarter, as a result of a six-week UAW strike at the major three automakers, Zandi said.

The real issue, though, is that other challenges could be ahead, too.

The impact would be small, but meaningful, Zandi said, particularly in the context of other headwinds to growth in coming months, including higher oil prices, higher mortgage rates, the end of the student loan payment moratorium, and a potential government shutdown.

"Under reasonable scenarios, economic growth could come close to a standstill in the fourth quarter," Zandi said.

Overall, Zandi already expects a soft fourth quarter, with growth at 0.8% and a UAW strike of some length could take that projection down to growth around 0.6% or lower.

Zandi's projecting a strong third quarter where the country's GDP grows at an annualized 2.8%.

The U.S. economy isn't the same as it was back just four years ago − and inflation and higher interest rates clearly are putting more pressure on households.

Back in the late summer and fall of 2019, we weren't worried about inflation. Mortgage rates were around 3.87% for the average 30-year-fixed mortgage on Sept. 15, 2019, according to Bankrate.com data, not an average 7.42% as they were earlier this week.

The average 60-month new car loan rate was 4.62% in September 2019, not 7.45% as it is now.

The Federal Reserve was in the process of driving interest rates down to boost economic growth when the 2019 strike began.

We've been dealing with red hot inflation for the past year or so, including a significant climb in auto prices. Pandemic-related supply chain disruptions around the world had dramatically reduced auto inventories and pushed up prices of cars and trucks in recent years.

Zandi said it's important to note that a UAW strike against the automakers would reduce already low vehicle inventories. But other experts note that inventories, particularly for profitable full-size pickup trucks, have improved and might be able to weather the storm of a strike early on.

A concern remains, though, that a prolonged strike and extended disruptions in inventories would drive up vehicle prices, Zandi said, stymieing the current disinflation and putting added pressure on the Fed to either raise interest rates again or delay when they will start cutting them.

All eyes in Detroit, though, are no longer on the Fed or Fed Chair Jerome Powell. Everyone is watching the UAW's Fain and wondering, really, what's next?

Contact personal finance columnist Susan Tompor: stompor@freepress.com. Follow her on Twitter @tompor. Auto writers Jamie L. LaReau and Eric D. Lawrence contributed.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.