UAW strike: Union battle with Detroit automakers escalates to PR war, will hurt consumers

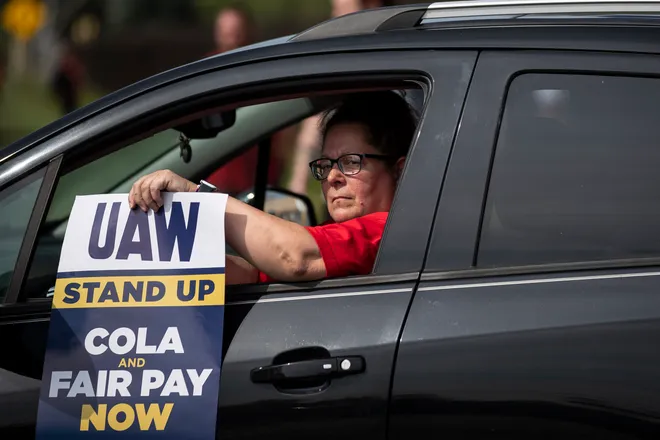

The UAW's battle for a new contract with the Detroit automakers has escalated to a public relations war framed in open-door dealing, news release attacks and leaked private communications from both sides.

And the collateral damage of the strike's latest targets will be consumers.

"This will not be a Cinderella story in the end," Dan Ives, managing director and senior equity research analyst at Wedbush Securities, told the Detroit Free Press, part of the USA TODAY Network. "Demand for the cars gets reduced in the strike, profits go down and it results in a higher price structure. And who's going to have to pay for it? It's consumers."

UAW President Shawn Fain has said the union is in a defining moment to fight for better wages and working conditions and win back some concessions it gave up during the great recession when the automakers faced bankruptcy. It's all deserved, Fain says, because of the billions of dollars in profits union members have helped the company earn. He's often noted the bigsalariesthe CEOs make.

So on Friday, the UAW expanded its week-old strike to include 38 of GM and Stellantis parts distribution centers across the nation, shutting down the facilities that deliver the parts that car dealers need to make repairs to customers' cars. About 5,625 workers walked out.

This adds to the 13,000 already on strike since Fain declared a historic walkout targeting all three of the Detroit automakers when the labor contract expired at 11:59 p.m. on Sept. 14.

A shrewd move 'ups the ante'

Fain's latest chess move in his so-called Stand Up Strike — which is to choose targets to strike at varied times to keep automakers off-guard — is a risky play, labor and car sales experts said. It could bring big wins for the UAW at the bargaining table in short order or backfire badly in the long run if customers migrate to other brands, thereby hurting the companies' profits and eroding union jobs.

"The latest move attacks GM and Stellantis on a whole new level, getting the dealer base involved by threatening one of the most crucial and profitable lines of business is certain to get dealers to be vocal, and dealers have no issue with telling manufacturers how they feel," said Ivan Drury, director of Insights at Edmunds.com. "While this was already national news, taking the strike to people's front doors ups the ante."

The union spared Ford Motor Co. in Friday's expansion of the strike because Ford has made progress at the bargaining table, where GM and Stellantis have not. Unlike long-held custom that kept these contract talks behind closed doors, details of these negotiations are aired publicly through daily announcements, verbal attacks and counter-attacks. Outside parties are drawn into the fray, from suppliers to customers and business owners.

Indeed, by picking GM's and Stellantis' parts depots as strike targets, the UAW is "punching dealers in the stomach" because dealers typically make bigger profits from service work than from car sales, said Erik Gordon, business professor at University of Michigan's Ross School of Business.

"The dealers aren't parties to the negotiations, they are bystanders," Gordon said. "The UAW is making them collateral damage and is spreading the economic effects across the country."

A risk for a reward

It is a move that could go wrong for the union, Drury said, noting that, "attacking the circle of automotive life, threatening people who bought a car seven years ago makes the strike difficult for the consumer to get behind if they're not able to get parts and drive their child to school or go to work. Hard to get that customer to step back into the dealership. Dicey stuff, but no risk, no reward."

Will UAW strike increase car prices?Experts weigh in.

The strike could also backfire if the union's demands are publicly viewed as being too unreasonable, said Jeffrey Kopp, partner at national law firm Foley & Lardner.

"The overwhelming majority of the national public already is skeptical that a four-day workweek proposed by the UAW will permit the Big 3 to remain competitive with the foreign counterparts," Kopp said in an email to the Free Press.

What to know about the 4-day workweek:It's among the UAW's strike demands. Here's what experts say.

But the latest strike move is shrewd financially for the UAW, said Art Wheaton, director of Labor Studies at Cornell University. Doling out strike pay to some 19,000 sidelined workers per week is a lot less expensive than taking all 150,000 autoworkers across the Detroit Three out at once.

"So you’re not draining your strike fund, but exerting tremendous pressure at the bargaining table," Wheaton said.

Also, the pain is not being felt directly by GM or Stellantis, but rather by the dealers and the consumers.

"So now you have the end customer screaming at GM," Wheaton said. "GM is trying to win the public relations war and they are losing badly."

Leaked texts talk about wounding carmakers

As if the strike alone weren't enough, a string of leaked private messages written by a top UAW aide suggests how far the union may be willing to go, indicating plans to damage the companies' reputations, create chaos and "keep them wounded for months."

The messages, obtained by the Detroit Free Press, are from UAW Communications Director Jonah Furman and were posted online recently in a supposedly private group chat on X, formerly called Twitter. The Detroit News and Automotive News first reported the texts. Furman declined to comment on them to the Free Press.

The messages say the UAW's goal is to use the strike strategy to win gains from the Detroit Three because the automakers will be "bargaining against each other." The UAW has foregone the past practice of picking one target company to get a contract to then use as a pattern with the other two. It is instead negotiating with all three separately, but simultaneously, and very publicly.

Ford's spokesman Mark Truby said in a statement that the leaked messages from Furman are "disappointing, to say the least, given what is at stake for our employees, the companies and this region."

GM said in a statement: "It’s now clear that the UAW leadership has always intended to cause months-long disruption, regardless of the harm it causes to its members and their communities. The leaked information ... shows a callous disregard for the seriousness of what is at stake." GM said it put a fifth "record offer on the table" and is ready to continue to bargain in good faith.

Stellantis spokeswoman Jodi Tinson said Friday in a statement, "We question whether the union’s leadership has ever had an interest in reaching an agreement in a timely manner."

'Unfortunate' messages won't matter

But the labor experts shrugged off the leaked messages affair, saying Fain has, essentially, "been saying as much and more for weeks," U-M's Gordon said.

As the Free Press first reported in May, a report written by Fain's transition team manager outlined the new president's mantra for shaking things up and using new strategies.

"The texts were unfortunate and unneeded, but I don't think they will tarnish the reputation of the union or public sympathy for the strike," said Harley Shaiken, a labor expert and professor emeritus at the University of California-Berkeley.

Shaiken said the remarks were not a strategy document and they reflect the union's short-term goal to win contract gains, also, "Furman is UAW communications director not Shawn Fain speaking. Damage? Likely a speed bump at most."

Wheaton agreed adding, "If you’re trying to make record contracts, you’re going to have some ruffled feathers They knew they had to have a strategy their strike fund could withstand and still add chaos in the system."

But lawyer Kopp said the messages show that the UAW leadership has an ulterior motive and "supports an argument that the leadership is bargaining in bad faith. This can’t cast the UAW leadership in a positive light and is quite disappointing."

Crossing picket lines, stockpiling parts

GM has taken its own action to combat the union's new strike targets by asking some salaried nonunion employees to volunteer to cross the picket line to help pack and ship parts from its strike-idled parts distribution centers.

In an internal email, which the Detroit Free Press obtained, GM asked team leaders before the strike if they had any volunteers for such a commitment, which it viewed as temporary, dependent on the length of the strike. Unions are highly critical of such line-crossing.

There are other ways to get around a lack of parts. Some dealers, such as Bowman Chevrolet in Clarkston, started to gather extra stock in recent weeks, said owner Katie Coleman. She said she also increased her used car inventory by about 20% over the past few weeks and now has a 90-day supply of used cars to sell.

"We took some more in new too, about 5% where we could in new, but new is harder to get," Coleman told the Free Press. "We’ve basically been taking everything. Most dealers have taken everything, as have we.”

White-knuckled Wall Street

As the strike continues and possibly escalates, Kopp, whose law firm has clients who are parts suppliers worldwide, said there will be further fallout to such ancillary businesses. Many have already laid off workers, due to the three assembly plants in Michigan, Ohio and Missouri that were first targeted in the strike.

Potential impact:Auto suppliers say if UAW strikes expand to more plants, it could mean the end for many

The uncertainty around the automakers also will not bode well for investors because Wall Street hates unpredictability. Wedbush's Ives called it "a white-knuckle period for investors trying to decipher what the shape and size of this strike looks like over the coming weeks and potential months."

"Ford played nice in the sandbox with the UAW and it puts more pressure on GM and Stellantis around how long they'll hold out and what an eventual deal looks like," Ives said. "It's a game of high stakes poker, but GM is putting a hard line in the sand because they recognize if they make the wrong deal it could permanently impair the business model."

GM has invested $35 billion through 2025 to transition to eventually selling all-electric vehicles. It has several due to launch this year and getting them to market on time is critical to start profiting on EVs. Plus GM had some stumbles in production in early rollouts of the GMC Hummer EV and Cadillac Lyriq, which it planned to make up for by year-end.

"There's two freight trains coming to a collision: the union train versus the electric vehicle green train," Ives said. "If GM gives in to all the UAW demands it would be a Titantic-like ending. It doesn't work with the business model. They'll have to pass these costs on with higher-priced vehicles, which throws out the EV strategy of affordable EVs for the mass market."

GM has more riding on the EV transformation than Ford because it invested so much in its proprietary Ultium battery propulsion system, Ives said. Competitor automakers not involved in the strike will benefit, Ives said, adding that "Tesla has champagne on ice watching this."

Morningstar's David Whiston said it is imperative that all three carmakers get a deal so the strike threat and distraction goes away.

"The development (Friday) is Ford is giving a lot more than the other two firms," Whiston told the Free Press. "So the risk is: Will Ford strike a deal that the other two don’t want, but may have to do to end the strike?"

More:Biden coming to Michigan to support striking auto workers

Staff writer Phoebe Wall Howard contributed to this report. Contact Jamie L. LaReau: jlareau@freepress.com. Follow her on X @jlareauan.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.