3 crucial questions to ask yourself before taking Social Security in 2024

Retirement is an exciting milestone in life, and Social Security can go a long way toward making retirement more affordable for many people.

However, certain misunderstandings about how the program works can be dangerous. If you begin taking benefits without knowing how your decisions might affect your monthly payments, it could cost you throughout the rest of your retirement.

If you're planning on taking Social Security within the next year, there are three important questions to ask yourself right now.

1. Do you know your full retirement age?

Your full retirement age (FRA) is the age at which you'll receive the full benefit amount you're entitled to based on your work history. Only 13% of U.S. adults can correctly name their FRA, according to a 2023 survey from the Nationwide Retirement Institute, so you're not alone if you're unsure of yours.

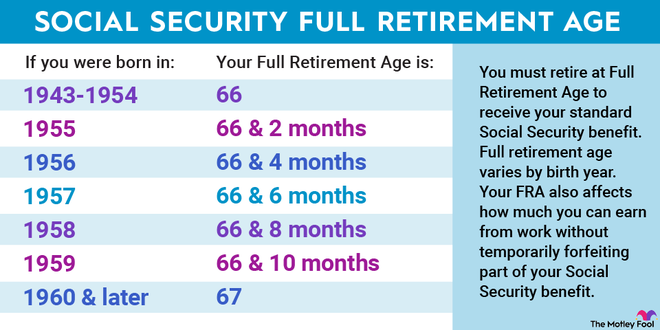

Your FRA will depend on your birth year. Anyone born in 1960 or later has an FRA of 67 years old. If you were born before 1960, your FRA is either 66 or 66 and a few months, depending on the year you were born.

It's important to know your FRA because it will affect your benefit amount. If you claim before this age (as early as age 62), your benefits will be permanently reduced by up to 30%. By delaying benefits past your FRA (up to age 70), you'll collect your full benefit amount plus a monthly bonus of at least 24% for the rest of your life.

2. Do you know your estimated benefit amount?

Even if you're not retired yet, you can still see approximately how much you'll receive in benefits once you start taking Social Security. To do so, you'll need to check your statements. If you're not receiving paper statements in the mail, you can view them through your mySocialSecurity account online.

Your benefit estimate is based on your real earnings throughout your career, and it's the amount you'll receive if you begin claiming at your FRA. Again, if you file before or after this age, it will affect how much you'll collect each month.

Once you know how much to expect from Social Security, it will be easier to determine how much you'll need to rely on your savings or other sources of income. If you find that you'll be receiving less than expected in benefits, it's better to know that sooner rather than later.

Is it enough?:Even after a Social Security COLA boost in 2024, seniors will fall short. Here's why.

3. Do you know how much you can (realistically) depend on benefits?

For many retirees, Social Security is a primary source of income. But it was never designed to be a sole income source, and it could be even less reliable in the future.

The program has been having cash flow problems in recent years, with the trust funds slowly running out. The good news is that Social Security is not going away entirely. However, according to the Social Security Administration's most recent estimates, Congress has roughly a decade to find a solution. Otherwise, benefits could be slashed by around 20% by 2034.

Also, Social Security has struggled to keep up with rising inflation. In fact, benefits have lost around 40% of their buying power since 2000, according to a 2022 report from The Senior Citizens League. If this trend keeps up, benefits may not go nearly as far in the coming decades.

There's not much you can do about these issues. But it is important to think about how much you can (realistically) depend on Social Security, especially if your benefits are going to be your main source of income.

Social Security can help make retirement more affordable, but it can be confusing at times. If you're expecting to begin taking benefits in 2024, knowing the answers to these three questions will help ensure you're as prepared as possible.

The Motley Fool has a disclosure policy.

The Motley Fool is a USA TODAY content partner offering financial news, analysis and commentary designed to help people take control of their financial lives. Its content is produced independently of USA TODAY.

Offer from the Motley Fool:The $21,756 Social Security bonus most retirees completely overlook If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $21,756 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after. Simply click here to discover how to learn more about these strategies.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.