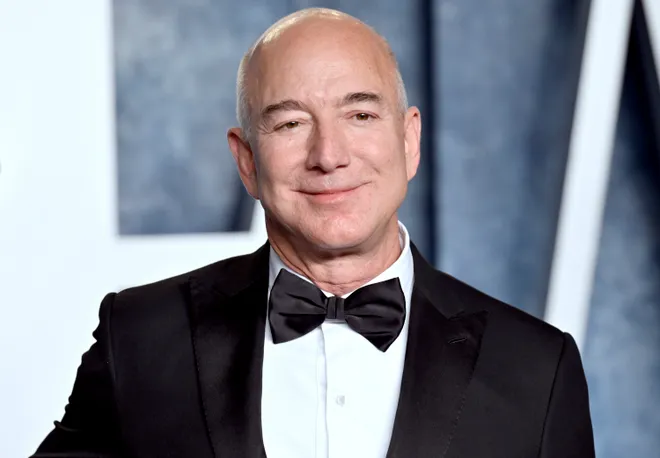

Amazon founder Jeff Bezos just saved millions on a recent share sale. Here's how.

One of the wealthiest men in the world now has a lot more cash on hand.

Jeff Bezos has been unloading Amazon stock at a fast clip, selling nearly 25 million shares worth $4 billion since February 7. And there’s likely more to come; Amazon’s latest annual report noted that the executive chair plans to sell a total of 50 million shares total by Jan. 31, 2025.

Experts say the sales make sense. Amazon's share price is up, and Bezos’s recent move from Seattle to Miami means he can sell without worrying about Washington state’s new capital gains tax.

“It’s an optimal time to make this move,” said Neil Saunders, managing director of analytics company GlobalData.

Why now?

Amazon's stock price has soared. Shares of the e-commerce company are up about 70% over the past year, outpacing the S&P 500, which gained about 20% in that time.

Saunders said this allowed the Amazon founder to “cash out at a high" nearly three years after stepping down as CEO. (As executive chair, Bezos focuses more on "new products and early initiatives.")

“This is part of the process of stepping back from Amazon,” Saunders said. “It doesn’t mean deserting it. He’ll always be the founder. But he’s no longer running that business. So I think this is part of him loosening his ties with Amazon and allowing Amazon to stand more on its own two feet.”

And with most of Bezos' wealth tied to Amazon, it makes sense to diversify his holdings, according to Michael Roberts, the William H. Lawrence professor of finance at the University of Pennsylvania's Wharton School.

"From a risk management standpoint, that's not a good strategy, putting all your eggs in one basket," he said.

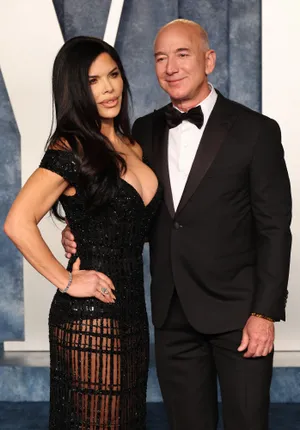

Bezos sold the stock shortly after he snapped up property in Florida. The billionaire in November said he would be moving to be closer to family and the operations of his Blue Origin rocket company -- and because he and his fiancée Lauren Sanchez “love Miami.”

The move to Florida also allows Bezos to avoid Washington state’s new 7% capital gains tax, which applies to the sale of assets like stocks and bonds worth more than $250,000.

Until the recent flurry of Amazon share sales, Bezos had last sold the stock in 2021. That was prior to the new state tax, which took effect the following year. Before then, the Amazon founder had sold Amazon stock regularly to finance projects like Blue Origin.

Waiting until his move to Florida to offload more shares has likely already saved Bezos an estimated $288 million.

Amazon did not respond to a request for comment from USA TODAY.

A widow opened herself up to new love:Instead, she was catfished for a million dollars.

Is this level of offloading normal?

Yes and no.

Saunders said it’s “quite usual” for a company founder holding a large number of shares to offload from time to time. But $4 billion is a big number, no matter how you look at it.

It “underlines the strength of Amazon,” he said. “You can dispose of quite a high volume without having it having an impact on the share price."

If Amazon's price was on shakier footing, Saunders said, there would be fewer people willing to pick up the shares, which would hurt the stock price.

Bezos is expected to offload another 25 million-plus shares under the pre-scheduled selling plan, worth another $4 billion at today's stock price. The sale would still leave Bezos with more than 900 million Amazon shares.

"This is such a small fraction of his overall wealth, even though it's a very big number," said Roberts of the University of Pennsylvania. "It's not as if he's trying to liquidate all his Amazon holdings. This is small potatoes. He's worth almost $200 billion, in which case we're talking about 2% of his wealth."

What does Bezos' share sale mean for Amazon?

Very little, according to Saunders.

“It’s not as if Jeff Bezos is selling these shares because he doesn't have confidence in the company anymore,” he said. “It’s just someone that is cashing out their shareholding, which is very understandable.”

Amazon's share price on Wednesday closed up 1.39% at $170.98.

Saunders added that as far as Amazon shoppers are concerned, this offloading “means nothing at all.”

What is Bezos buying with $4 billion?

As for where that $4 billion is going, that’s anyone’s guess.

Saunders said he doesn’t expect Bezos to buy Florida property “because he has more than enough money to do that already.”

The 60-year-old has already purchased two mansions in Indian Creek Village, one of the richest neighborhoods in the country.

Bezos likely “has other grand pans and investments that he wants to make with that money,” Saunders said. But “I don't know what he has planned.”

Bailey Schulz is an investigative and general assignment reporter covering Money issues.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.