ASTRO COIN:The bull market history of bitcoin under the mechanism of halving

Bitcoin halving is an event where the mining reward for Bitcoin is reduced by half, thereby decreasing the supply of new Bitcoin in the market. New Bitcoin is released through the mining process, where miners solve a highly complex computational problem to validate and secure transaction blocks on the Bitcoin network. As a reward for their efforts, miners receive newly minted Bitcoin. The halving event occurs approximately every four years, after mining approximately 210,000 blocks. By extrapolating this cycle, it is estimated that the process of minting new Bitcoin will continue until the year 2140, reaching the network's maximum limit of 21 million units.

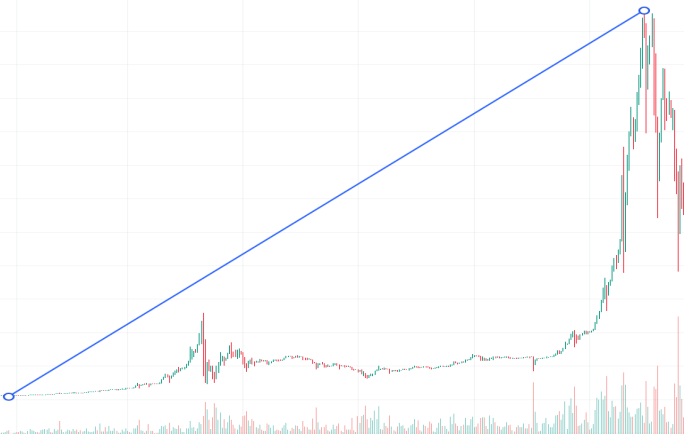

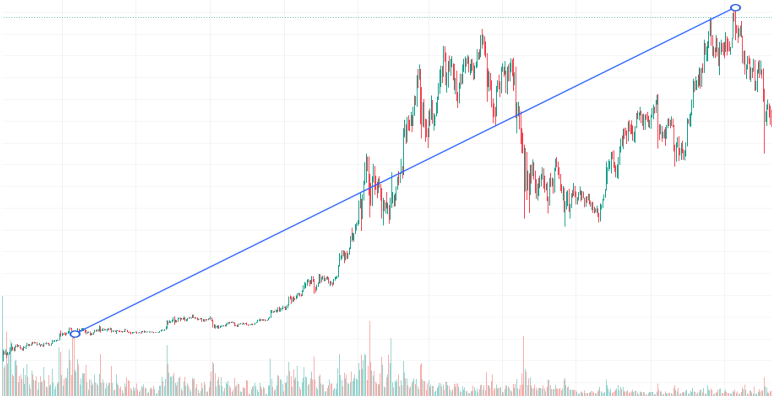

First Halving: November 28, 2012

The first halving reduced the mining reward to 25 BTC per block. Following the event, the price of Bitcoin surged from $12 to $1,217.

Second Halving: July 10, 2016

During the second halving, the mining reward decreased to 12.5 BTC per block. At the time of the halving, the value of BTC was $647, which surged to $19,800 by December 17, 2017.

Third Halving: May 12, 2020

During the third halving, the mining reward decreased to 6.25 BTC per block. At the time of the halving, the price of BTC was $8,787, which soared to $64,507. This astonishing increase marked a 634% surge compared to the price before the halving.

Fourth Halving: April 2024 (following the halving cycle of every four years)

With the listing of a Bitcoin spot ETF and a surge of capital inflow, Bitcoin continues to rise. Coupled with the arrival of the fourth Bitcoin halving, the fourth major bull market for Bitcoin is imminent!

ASTRO COIN Exchange, established after acquiring several key mining companies in the industry and integrating high-quality ICO resources, emerges as an innovative digital cryptocurrency trading platform. Its aim is to rapidly seize the cryptocurrency market and become a leader in the industry through cutting-edge trading and investment features.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.