The pause is over. As student loan payments resume, how to make sure you're prepared

It’s been a while since millions of people have had to make any federal student loan payments, thanks to a pandemic-driven pause that has put both payments and interest on hold for more than three years.

Since then, many have gone on with their lives in a post-pandemic world, working off budgets that didn’t need to take student loan payments into account, mindful of but perhaps unwilling to acknowledge the approaching T-Rex in the rearview mirror.

That’s all about to change. Student loan repayments will resume in October, and interest on those loans is set to begin accruing startingFriday.

Despite several postponements, this restart part of a debt ceiling bill Congress approved in June to avoid default. Student loan debt totaled more than $1.77 trillion by the end of March, with 92% of that amount tied to federal student loans.

Here's what the nearly 44 million Americans with outstanding federal student debt should know to prepare.

How do I pay off my student loans?

One expert estimates that 44% of borrowers have seen their loan servicers change since before the March 2020 pause. Emails started going out in July identifying loan servicers, with a link to their website.

Recent graduates or attendees who have never made a payment should be extra vigilant about checking for changes; they may not even know their servicer or have ever been in touch with one because their federal student loans were covered under the CARES Act forbearance program.

If you have a Federal Student Aid account, you can confirm your servicer at StudentAid.gov under the heading “I need more information about my loan servicer.” Those without an account can create one using their Social Security number and email address and/or mobile phone number at https://studentaid.gov/fsa-id/create-account/.

Borrowers will be notified of their monthly amount due 30 days before the due date, and bills should start appearing in mailboxes from mid-September through early October, at least 21 days before they are due.

Interest rates can depend on the type of loan and when it was dispersed; more information about interest rates is available on the federal Student Aid website.

The National Association of Student Financial Aid Administrators offers an online Student Loan Repayment Toolkit that can guide borrowers through the process.

How can I lower my student loan payments?

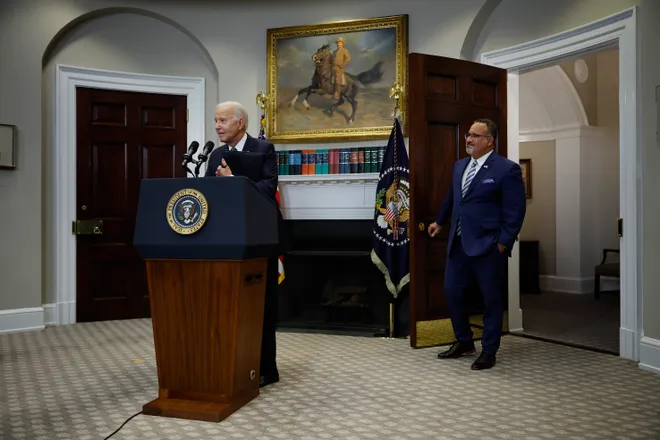

The Biden administration, aiming to fulfill promises of broad student loan forgiveness, has already erased $116 billion in student loans for 3.4 million borrowers, mostly through programs benefiting people employed in public service or who’ve been defrauded by their schools.

Earlier this summer, the U.S. Supreme Court killed Biden’s proposed Plan A, a forgiveness plan that could have benefited more than 40 million borrowers.

Last month, the Biden administration announced a repayment plan touted as the “most affordable” option available to reduce monthly debt, one expected to especially benefit low- and middle-income borrowers who might be saddled with other debt.

The Saving on A Valuable Education (SAVE) program, which goes into effect in July, is designed to help cut monthly payments, cap interest build-up and decrease the total amount necessary for borrowers to pay off their debts.

Participating borrowers could cut their payments in half or even completely, depending on their family size and level of discretionary income, defined as the difference between one’s adjusted gross income and 225% of the federal poverty line.

Payments for borrowers with undergrad loans only, for instance, would top out at 5% of their discretionary income, while a borrower with no discretionary income would have no monthly payments.

“This plan is a game changer for millions of Americans, many of whom are putting off having children, buying their first home or even starting a business because they can't get out from under their student loans,” White House domestic policy advisor Neera Tanden told reporters in a conference call last month.

Student loan balances often balloon when interest exceeds the required monthly payment, leading to negative amortization. The SAVE program has a feature to prevent that from happening as long as participants make their required payments, an option the U.S. Department of Education estimates could benefit more than two-thirds of borrowers who were on income-based plans before the pandemic.

Borrowers can enroll in the program at StudentAid.gov/SAVE. Participants in its predecessor, the Revised Pay As You Earn (REPAYE) plan, will be automatically enrolled. Balances would be cleared after a certain number of years in the program.

Who qualifies for student loan forgiveness?

A federal judge last month dismissed a lawsuit from conservative groups seeking to block student loan forgiveness, clearing the way for the cancellation of about $39 billion in outstanding debt for more than 800,000 borrowers, most of them 50 years of age or older, who’ve already made at least 20 years of payments.

But there are other ways to qualify, too, including a career in public service. The federal Public Service Loan Forgiveness Program includes forgiveness for borrowers who pursue careers in fields that include social workers, public health professionals, law enforcement officers and early childhood educators.

Under the program, qualified borrowers who make 10 years of consecutive payments can see their remaining balances wiped out if they’re working full-time in government or not-for-profit roles.

Full-time teachers at low-income elementary and secondary schools, or those working at educational service agencies, may also qualify for partial loan forgiveness, with additional breaks possible for qualified math, science and special education instructors.

Other forgiveness options are available to those with federal Perkins Loans, those whose schools have closed, victims of forgery and those who’ve declared bankruptcy.

What else should I know?

Dec. 31: Individuals with non-Department of Education debts such as a school-held Perkins loan, a commercially held Federal Family Education Loan (FFEL) or a Health Education Assistance Loan (HEAL) need to consolidate them into a new Direct Consolidation Loan by Dec. 31 to get loan credit under the IDR account adjustment for income-driven repayment plans.

That adjustment could change whether certain payments or months are credited toward forgiveness. Borrowers employed in public service are required to fill out employment certification forms and Public Service Loan Forgiveness applications by year's end. Borrowers with payments remaining after the review will need to enroll in an income-driven repayment plan.

March: Those on income-driven repayment plans before the pause will have until around March to recertify their income, which could be important if one's family is larger or income has fallen. Borrowers can recertify early via the IDR application by selecting the icon next to "Recalculate my monthly payment."

July: Benefits offered through the federal SAVE program begin, with undergraduate loans cut in half and borrowers with both undergraduate and graduate loans paying a weighted average between 5% and 10% of their income based on their original principal balances.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.