New federal rule may help boost competition for railroad shipments at companies with few options

OMAHA, Neb. (AP) — Companies that have plants and facilities only served by one railroad may soon be able to get a bid from another railroad if their current service is bad enough under a new rule that was proposed Thursday to help boost competition.

Railroad shippers with plants that are only served by one railroad may soon be able to get a bid from another railroad if their current service is bad enough under a new rule that was proposed Thursday to help boost competition.

The U.S. Surface Transportation Board announced the long-awaited rule that has been under consideration in some form at least since 2010 to provide some relief to so called “captive shippers” that only have a connection to one of the six giant freight railroads that deliver the vast majority of goods across North America.

Many companies have complained about poor railroad service over the past couple years as the industry worked to recover from the depths of the pandemic. The railroads have acknowledged they cut their workforces too deep in 2020 and had a hard time hiring enough workers to handle all this shipments once demand returned because of the tight labor market and quality of life concerns over railroad work.

After summit joined by China, US and Russia, Indonesia’s leader warns of protracted conflicts

After summit joined by China, US and Russia, Indonesia’s leader warns of protracted conflicts

Biden will nominate a former Obama official to run the Federal Aviation Administration

Biden will nominate a former Obama official to run the Federal Aviation Administration

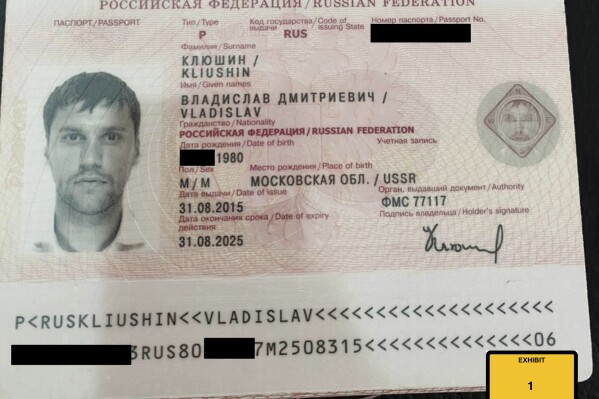

Wealthy Russian with Kremlin ties gets 9 years in prison for hacking and insider trading scheme

Wealthy Russian with Kremlin ties gets 9 years in prison for hacking and insider trading scheme

The railroads have made significant strides to improve service since the worst of the problems in the spring of 2022 as they hired more train crews, but labor unions have questioned whether the industry’s current lean operating model gives railroads enough capacity to handle all this shipments safely even after the recent hiring.

STB Chairman Martin Oberman said it’s clear to him that increasing competition in this monolithic industry could do wonders for the countless companies that rely on railroads to deliver raw materials and finished products by giving railroads another incentive to improve service. The rail industry is dominated by six major Class I railroads with two in the west, two in the east and two in Canada although one of those now also has tracks that cross the Midwest and connect to Mexico after a recent merger.

“This rule will bring predictability to shippers and will provide Class I carriers with notice of what is expected of them if they want to hold on to their customers who might otherwise be eligible to obtain a switching order,” Oberman said.

Shippers would only be able to seek out a competing bid under this rule if their current railroad can’t deliver an average of 60% of its shipments on time over a 12-week period. Later that standard would increase to 70%.

Shippers would also be able to seek relieve if the amount of time it takes the railroad to deliver a product significantly worsens or if the railroad fails to handle local deliveries on time on average.

The railroads have long opposed this idea because they argued it might discourage them from investing in certain rail lines if they aren’t even handling the shipments there and it could create more congestion if they have to let competitors come onto their tracks to pick up goods. Although Canadian regulators have long had similar rules that allow companies to hire other railroads to deliver their goods.

The head of the Association of American Railroads trade group Ian Jefferies said the railroads are studying the new rule to determine how big of an impact it might have on their operations.

“Any switching regulation must avoid upending the fundamental economics and operations of an industry critical to the national economy,” Jefferies said.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.