South Carolina senators grill treasurer over $1.8 billion in mystery account but get few answers

COLUMBIA, S.C. (AP) — A group of South Carolina senators didn’t get much clarity Tuesday as they sought answers about how $1.8 billion ended up in a state bank account over the past decade without anyone knowing where it came from or was supposed to go.

The two typically elected officials responsible for the state’s accounting and bank accounts — the comptroller general and treasurer — appeared before a Senate subcommittee.

The agenda said they were giving their budget requests. But almost the whole four-hour meeting was consumed by the missing $1.8 billion and other accounting errors that happened as the state shifted accounting systems in the mid-2010s.

Investigative accountants are still trying to untangle the mess, but it appears that every time the state’s books were out of whack, money was shifted from somewhere into an account that helped balance it out, state Senate leaders have said. In a different problem, the state was double-counting higher education money to the tune of almost $4 billion.

Comptroller General Brian Gaines, who took over for the elected Republican director after he resigned when the accounting errors started to emerge last year, spoke for about 10 minutes. He promised to continue to help senators in any way to unravel the mess and said the account in question where the $1.8 billion went was created by the treasurer’s office.

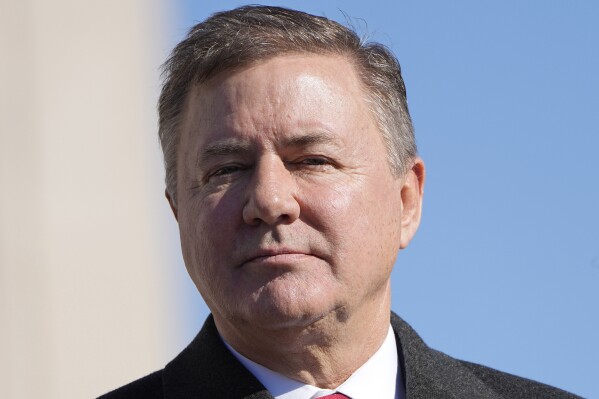

Gaines was followed by Republican Treasurer Curtis Loftis, who for nearly four hours repeatedly told the senators keeping the books balanced isn’t his responsibility and that he can’t get any information out of the comptroller general’s office.

Loftis asked for more time to find answers, yelled at senators for suggesting he wasn’t telling the truth and begged the Democrats on the subcommittee to come to his rescue.

“Senators, I’m at a bit of a disadvantage. Six people can ask me any question about the last 14 years,” Loftis said.

Loftis said that his job is to be the state’s banker and investment chief and that the comptroller general reconciles the books. Loftis said the comptroller general also refused to share key information, an allegation the other agency denies.

“If we weren’t arguing, we could solve this problem. I’ve been given the responsibility without the authority,” Loftis said.

There were some hints of new information at the meeting.

The $1.8 billion may not be sitting around waiting to be spent on things like teacher salaries or prison improvements, and could actually end up taking cash from those things.

Republican Sen. Stephen Goldfinch said there are indications the money may belong to other entities, such as the state department of transportation, the federal government or an environmental trust fund. If the money is accounted for, the state may have to pay back the interest it earned investing the $1.8 billion.

Senators perked up when Loftis briefly suggested there might be a criminal investigation into the money, which Loftis quickly shot down, saying they misunderstood him.

The meeting was suspended without any resolution. Several senators last week introduced a proposed constitutional amendment that would make the comptroller general an appointed instead of an elected position. They suggested a similar proposal for the treasurer to go before voters in November could come soon.

Stating at Loftis, his glasses perched at the end of his nose, Republican subcommittee chair Sen. Larry Grooms said that he thinks Loftis’ staff knew about the problems for seven years and that “if your staff knew, then you knew.”

“The treasurer’s office was responsible for maintaining the integrity of the banking and investments records, and it has failed,” Grooms said.

“No sir,” Loftis snapped back.

Grooms went on to say explanations by Loftis’ staff were not instructive, not totally accurate and seemed to be intended to blame anyone else.

“You have not accepted responsibility in the seven years they have occurred and the records of the treasury are a mess,” Grooms said.

“Senator, that is highly irresponsible. It is not accurate,” Loftis responded.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.