Gusts of activity underway by friends and foes of offshore wind energy projects

LONG BEACH TOWNSHIP, N.J. (AP) — Government supporters of offshore wind energy projects in New Jersey and New York are trading blows with opponents in some shore towns who say many vacationers and local residents don’t want to see turbines filling the ocean horizon.

Eight Jersey Shore beach towns wrote to state utility regulators Wednesday, saying one wind farm proposal will be vastly more expensive than projected, and will cost tourism-driven jobs and economic activity.

Their move came on the same day that federal energy regulators approved new rules to streamline the application and approval processes for offshore wind farms, and also the day that New York Gov. Kathy Hochul issued supply chain and logistics proposals to help her state’s offshore wind industry. Hochul’s move came days after three New York projects were scrapped because the companies and state regulators couldn’t agree on the financial terms.

Shore towns spanning much of New Jersey’s 127-mile coastline wrote to the state’s Board of Public Utilities, saying the proposed Atlantic Shores wind farm will be costlier than originally proposed, particularly if the developers are allowed to re-bid it.

An economic analysis sent by Long Beach Township, Beach Haven, Ship Bottom, Barnegat Light, Surf City, Harvey Cedars, Brigantine, and Ventnor predicts reduced visitation to the Jersey Shore by people who don’t want to see windmills on the horizon could cost Ocean County alone more than $668 million in economic losses.

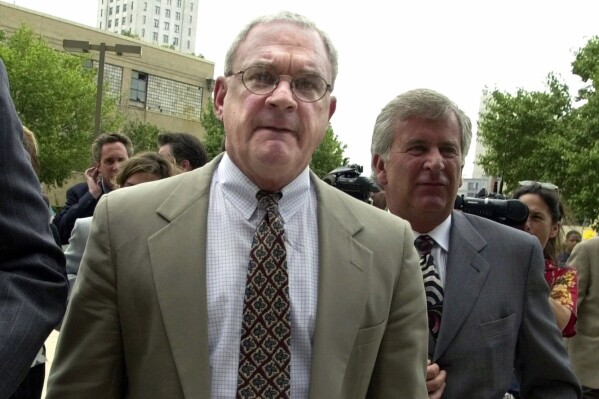

“The Atlantic Shores project will devastate the economies of the shore municipalities by deterring visitors and eliminating thousands of jobs,” said James Mancini, mayor of Long Beach Township on Long Beach Island. “It is imperative that any offshore wind projects are placed far enough out to avoid these drastic impacts, which adversely affect not only the shore municipalities’ residents, visitors, and businesses, but all of New Jersey’s residents.”

The towns also said allowing the project owners to re-bid would increase additional costs to ratepayers to $10 billion, up from $3.7 billion.

The BPU and Atlantic Shores did not immediately respond to a message seeking comment Thursday. But the New Jersey Offshore Wind Alliance said the law firm that wrote to New Jersey regulators is “engaged in misguided litigation against offshore wind development,” and that an operating wind farm off Block Island, Rhode Island proves that offshore wind farms can coexist with tourism and recreational fisheries.

Atlantic Shores would have 157 turbines and would be located 8.7 miles from shore, among the closest projects proposed for the state’s shoreline. It is a partnership between Shell New Energies US LLC, and EDF-RE Offshore Development, LLC.

It is one of three offshore wind projects currently pending in New Jersey. The state Board of Public Utilities in January chose Attentive Energy LLC and Leading Light Wind LLC to build offshore wind projects.

Also on Wednesday, U.S. Interior Secretary Deb Haaland announced that the Bureau of Ocean Energy Management and the Bureau of Safety and Environmental Enforcement finalized new regulations for offshore wind projects intended to save the industry $1.9 billion over the next 20 years. It would streamline some processes, eliminate what the agencies called duplicative requirements and allow money for eventual decomissioning work to be put up incrementally instead of all at once at the start of a project.

That same day, New York’s governor responded to the collapse of three offshore wind projects last week by issuing requests for proposals and information regarding supply chains and logistics for offshore wind projects. That followed the state canceling three preliminarily approved offshore wind projects after failing to reach final agreements with any of them

New York provisionally approved the projects in October 2023. They are Attentive Energy One being developed by TotalEnergies Rise Light & Power and Corio Generation; Community Offshore Wind, and Vineyard Offshore’s Excelsior Wind.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.