Planned Fossil Fuel Production Vastly Exceeds the World’s Climate Goals, ‘Throwing Humanity’s Future Into Question’

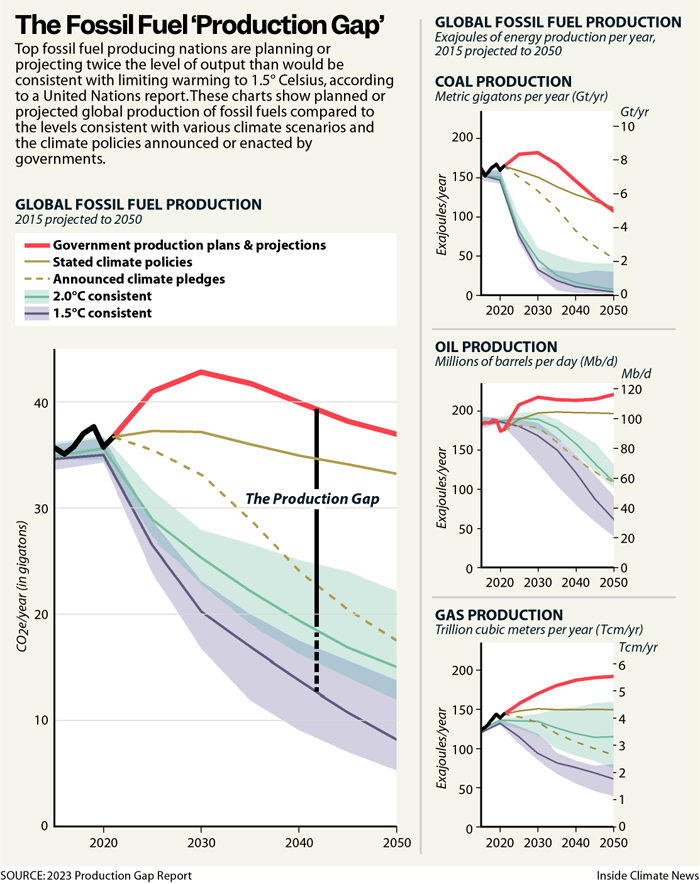

The world’s top fossil-fuel producing nations are still planning to increase their output of oil, gas and coal far beyond what the world’s climate targets would allow, according to a new United Nations report.

The findings reveal a widening gap between the emissions-cutting pledges these nations have made and their continued policies to promote mining and drilling within their borders.

Even as the vast majority of countries have adopted net-zero pledges to slash their climate emissions, their own plans and projections put them on track to extract more than twice the level of fossil fuels by 2030 than would be consistent with limiting warming to 1.5 degrees Celsius, and nearly 70 percent more than would be consistent with 2 degrees Celsius of warming, according to a report released Wednesday by the U.N. Environment Program.

Scientists say that beyond 1.5 degrees of warming, more extreme and dangerous changes to planetary systems will become increasingly likely.

This “production gap” between planned output and climate goals is a warning, the report said, that the transition away from fossil fuels remains off-course.

U.N. Secretary-General António Guterres called the findings “a startling indictment of runaway climate carelessness.”

Inger Andersen, the executive director of U.N. Environment Program, said in a statement accompanying the report that “governments’ plans to expand fossil fuel production are undermining the energy transition needed to achieve net-zero emissions, throwing humanity’s future into question.”

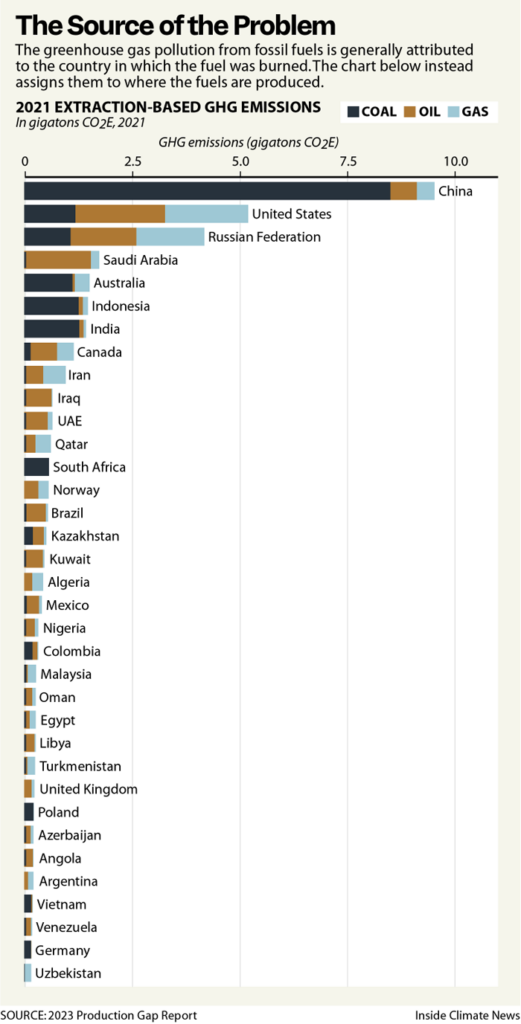

The 2023 Production Gap report, which was produced by four climate think tanks in partnership with the U.N. Environment Program, analyzed the plans and projections published by governments from 19 of the 20 largest fossil fuel producing nations (data from South Africa was not available). The authors used that data to come up with global production estimates that they compared to modeling by the U.N. Intergovernmental Panel on Climate Change of fossil fuel supply under various climate scenarios.

This production gap has remained largely unchanged since 2019, the first year the groups published the report. Authors said that highlighted the fact that despite increased ambition to introduce cleaner forms of energy, governments have yet to begin grappling with how they will cut the supply of fossil fuels.

Even as many nations have announced more ambitious climate targets, subsidies for fossil fuels reached their highest level last year, according to the International Monetary Fund. In some cases, governments were responding to the fallout of Russia’s invasion of Ukraine, which sent commodity prices soaring and reordered global energy markets.

Biden administration officials, for example, called on oil and gas companies to increase output to make up for lost Russian production, and have continued to support new terminals to export natural gas around the world. This expansion, the officials have said, is needed to help protect energy security and stabilize markets. In other cases, governments continue supporting production because of the revenues they depend on from selling oil, gas and coal, or their desire to reduce energy imports.

While many of these arguments might have merit on their own, “when you take all of this together, that’s what leads to the production gap,” said Michael Lazarus, a lead author on the report and U.S. center director at the Stockholm Environment Institute, during a presentation for journalists.

The gap remains widest for coal, with governments set to produce 460 percent more of the polluting fuel in 2030 than the 1.5 degree target would allow. For oil, government plans exceed the budget by nearly 30 percent, while for gas they exceed it by more than 80 percent.

These estimates are based on modeling that assumes some degree of success for technologies that would capture carbon dioxide emissions from smokestacks and remove it from the atmosphere, meaning the world could continue to use small amounts of fossil fuels for longer. But none of these technologies have been deployed at a meaningful scale yet, the authors warned, so a more cautious approach would require phasing out fossil fuel production even faster than their analysis suggests.

Of the 20 nations the report examined, 17 have carbon-neutral pledges but none have aligned their fossil fuel production policies with limiting warming to 1.5 degrees. Brazil, Saudi Arabia and the United States all foresee significant increases in domestic oil production, while Qatar and Russia project the biggest increases in gas output. For coal, India, Indonesia and Russia all plan for significant increases, which would counteract large reductions planned by China and the United States. For oil and gas, the only producers planning for significant declines in output are Norway and the United Kingdom.

The risk, the report said, is that countries will over-invest in new fossil fuel supply, slowing the transition away from coal, oil and gas and potentially wasting billions of dollars on projects that could be unnecessary as more clean energy sources come online. Last month, the International Energy Agency said it expects demand for all fossil fuels to peak this decade.

While the U.N. report focuses on the risk to nations, another study released this week examined the risk facing the investors and shareholders who support publicly-traded oil companies. In a new analysis, the Carbon Tracker Initiative, a climate-focused financial think tank, argued that oil companies are failing to anticipate that coming peak in demand and the inevitable decline that will follow, and as a result are planning to spend hundreds of billions on investments that might not provide returns.

“Companies that are planning on strong oil demand over the next two decades may be caught out,” said Mike Coffin, head of oil, gas and mining at Carbon Tracker.

Pointing to the projections from the International Energy Agency, the report said companies should focus on short-term oil and gas projects, diversifying their businesses or returning cash to shareholders rather than investing in new supply.

The message from the Production Gap report is similar, and it points to a handful of signs of progress. Canada, China, Germany and Indonesia have each begun developing scenarios for aligning domestic production with carbon-neutral targets, it said. Colombia, an oil producer, recently joined a group of countries committed to phasing out oil and gas production.

The report warns that a transition off fossil fuels could, if not properly planned, place further burdens on poorer nations that are highly dependent on revenue from production. To address this, the authors called for wealthy, less-dependent nations, such as the United States, to phase out production faster and also to help finance the transitions in developing countries.

One emerging model includes so-called Just Energy Transition Partnerships, where wealthy nations commit financing to help countries replace fossil fuels with clean energy. The United States and other countries have formed these partnerships with Indonesia, South Africa and Vietnam to phase out coal power plants.

Aligning plans for fossil fuel production with other climate goals would help avoid the price shocks and mismatches between supply and demand that have jolted the global economy since the coronavirus pandemic sent energy use plummeting in 2020, the report said. That will require a level of cooperation between nations that has been lacking so far.

The Paris Agreement was notoriously silent on fossil fuel production, and recent negotiations have revealed rifts over whether countries were willing to commit to phasing out coal, oil and gas. The new U.N. report comes just weeks before nations will gather again for their annual climate summit, in Dubai, and the authors said that one of the report’s key messages is for negotiators to finally adopt targets to wind down production.

Share this article

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.