A Progress Report on the IRA Shows Electric Vehicle Adoption Is Going Well. Renewable Energy Deployment, Not So Much

When the Inflation Reduction Act was becoming law in 2022, some of the country’s leading energy researchers and modelers projected how much the legislation would reduce greenhouse gas emissions.

The prediction was a cut of 37 percent to 42 percent by 2030 compared to the level in 2005, in line with the Biden administration’s stated goal of reducing emissions by 40 percent by 2030.

So how are things going 18 months after President Biden signed the IRA?

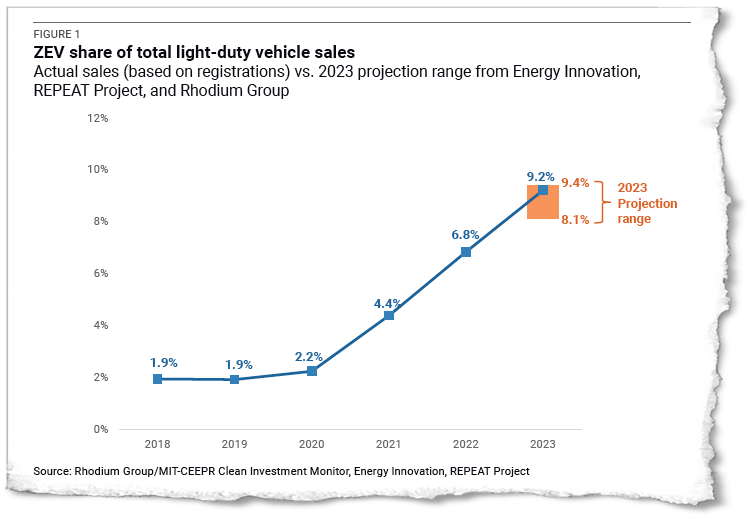

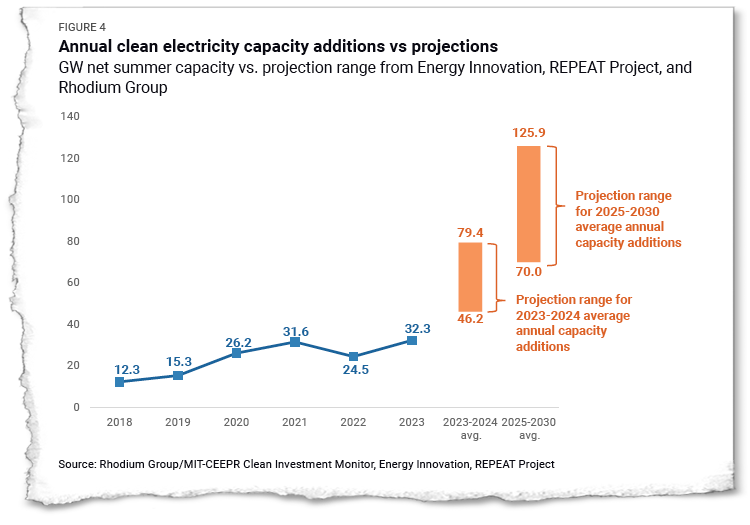

Some of the same researchers who made the forecasts issued a report this week that looks at progress in the transportation and electric power sectors. They found that the adoption of electric vehicles has been at the upper end of their range of expectations, while the deployment of renewable electricity has fallen slightly short of expectations.

We’re hiring!

Please take a look at the new openings in our newsroom.

See jobs“Probably the most disappointing story here is wind,” said Anand Gopal, executive director for policy research at the think tank Energy Innovation. “The two main other categories of renewables, solar and batteries, have grown since 2021. Wind has actually fallen in terms of annual additions since 2021. That is unfortunate, and a little bit surprising.”

He attributes the slowdown in wind energy development to a variety of factors, such as delays in obtaining permits, shortages of certain parts and community opposition to new wind farms, among others.

The new analysis is a follow up to forecasts from 2022 by Energy Innovation, Clean Investment Monitor (a project of Rhodium Group and the Center for Environmental Policy Research at the Massachusetts Institute of Technology) and the REPEAT Project (Rapid Energy Policy Evaluation and Analysis Toolkit) at Princeton University.

Their reports examined how the IRA and another major piece of legislation, the 2021 bipartisan infrastructure law, would contribute to emissions cuts.

The most encouraging part of this week’s follow-up is the rapid adoption of EVs, which is crucial considering that transportation is the country’s leading source of emissions.

“Given how much media reporting there has been on a potential slowdown in EV sales, we were surprised that 2023 came in at the very top of the projected range under the IRA,” said Trevor Houser, a partner at Rhodium Group in the research firm’s energy and climate practice, in an email.

He is referring to widespread concern, which I’ve written a lot about, that electric vehicles sales are slowing due to concerns about high sticker prices and inadequate charging networks.

EV market share, which the report lists at 9.2 percent of car and light truck sales in 2023, was near the top of the range—8.1 percent to 9.4 percent—that the forecasters had listed when the IRA was being passed.

The forecasts expect the growth rate of EV sales to slow, which is normal as a product moves from the fringes of the market toward the mainstream and high growth rates become harder to sustain.

The main question, in terms of projecting emissions cuts, is how much the growth rate will slow. The projections from the forecasters call for average annual growth in EV sales of between 30 percent and 44 percent from 2024 to 2026. (Here I’m describing the growth in annual sales, which is a comparison to prior-year sales, as opposed to market share, which counts how many EVs are sold compared to the entire auto market in a given year.)

Based on decisions of some automakers, such as Ford and General Motors, to slow their increase in production of EVs, and other short-term challenges for selling EVs, I think it’s going to be difficult for actual sales in 2024 to 2026 to be in line with the projections. But that’s just a guess on my part.

I asked Gopal what he thinks of one factor that could have a big effect on the market: the Biden administration’s potential revision to its proposed vehicle emissions rules, which would slow down requirements that automakers increase their EV sales. The New York Times has reported that the administration is likely going to make this revision in response to pressure from automakers, unions and dealers who say the rules would be too difficult to follow.

“I hope that they do not weaken the proposed EPA rule for vehicles, because the most certain way we’re going to hit high levels of EV penetration by 2030 is going to be through standards, not necessarily relying on just the Inflation Reduction Act,” he said.

But, he noted, federal fuel efficiency standards were not part of the models used to generate the 2022 forecasts, so a change in the standards wouldn’t affect the assumptions that went into the forecasts.

The part of the new report that I find most concerning is that the country is already behind on building enough clean electricity, despite lots of growth in solar and battery storage last year. And the forecasts’ expectations for new construction are going to go up by a lot in the next few years. The three forecasts had average annual growth in zero-emissions electricity capacity of 70 gigawatts to 126 gigawatts between 2025 and 2030.

Considering the country added about 30 gigawatts of zero-emissions electricity in 2023, and the multitude of ongoing challenges in building large projects, the numbers in the forecast look daunting.

The country needs to build a lot of clean electricity projects, and fast, to be on track with where things seemed to be heading at the time the IRA was passed.

I asked Gopal and Houser whether they are optimistic that the country will get to where it needs to be on emissions reduction.

“I will count myself in the more optimistic bracket of people,” Gopal said.

He points to the large investments that the government and companies are making in manufacturing of batteries and other clean energy components. The scale of investment “is just mind boggling,” he said, and should contribute to substantial growth in clean energy deployment once those projects are completed.

“I remain pretty optimistic,” Houser said. “The IRA has made clean energy and transportation cost-competitive with fossil fuels in almost all applications. But fully realizing the potential of the IRA requires building and selling clean energy infrastructure and vehicles at an unprecedented pace. That means overcoming a range of obstacles, from supply chain issues to siting and permitting times. But these are all solvable.”

It’s worth remembering the scale of the challenge. At the time the IRA became law, the United States didn’t have a clear strategy for cutting emissions. Now, the country has a strategy, but that doesn’t mean the task is easy.

“We left ourselves with a task of sort of climbing Mount Everest,” Gopal said. “The Inflation Reduction Act is the best set of Sherpas you can find to help you get through it right.”

Other stories about the energy transition to take note of this week:

A Look at the ‘Alternative’ Vehicle Emissions Rule Biden May Push: As I mentioned above, the New York Times reported that the Biden administration will revise its proposal for vehicles emissions rules in a way that will mean automakers don’t need to sell as many EVs in the short term. But Jean Chemnick of E&E News reports that the rules remain in flux, based on interviews with dozens of advocates, analysts and former federal officials. “I would think the way to view it is they’re probably honing in on where they think they’re going to go, but they probably haven’t absolutely made their final decision yet,” said Jeff Alson, a former career official at the EPA who worked on the first greenhouse gas rules in the Obama administration, speaking with E&E. This is a touchy subject in an election year, with U.S. automakers and the United Auto Workers arguing that EV demand is not yet strong enough for a rapid ramp-up, while environmental advocates say it would be foolish to slow the speed at which we move away from gasoline vehicles.

Republican Attacks on Biden’s Climate Law Raise Concerns Ahead of Election: Clean energy companies and industry groups worry parts of the Inflation Reduction Act could be rolled back if Donald Trump is elected in November, as Madeleine Ngo reports for the New York Times. A Trump administration could try to repeal the law with help from Congress, or undercut the law through actions by federal agencies. It’s a chilling possibility, considering that the IRA has led to massive investment in clean energy manufacturing.

EVs Are One Step Closer to Becoming Roaming Grid Batteries: University of Delaware professor Willett Kempton and his students are working to update a technology that he hopes will make it easier for batteries from electric vehicles to be available to the electricity grid, as Jeff St. John reports for Canary Media. The automotive standards organization SAE International last month approved an update to existing standards that makes it easier to set up connections between vehicles and the grid. Kempton and others have long viewed the country’s EV fleet as a potential backup battery for the grid. Utilities or grid operators could set up procedures that would allow them to draw electricity from EVs that are hooked up to chargers, and compensate the EV owners. If even a small share of EV batteries were available to the grid, the results could be significant in terms of having backup power available to communities at times of high demand.

In Wyoming, Sheep May Safely Graze Under Solar Panels in One of the State’s First ‘Agrivoltaic’ Projects: In Converse County, Wyoming, a proposed solar farm is notable for the way it would use the land beneath the panels for livestock grazing, as Jake Bolster reports for ICN. This is an example of agrivoltaics, which means that solar power is sharing the same land with agriculture. I am encouraged by the potential that farmers can find ways to boost incomes by combining solar and agriculture. And, as I reported two years ago, researchers have found that the shading from solar panels can improve outcomes for growing certain crops.

Share this article

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.