Prodigy to prison: Caroline Ellison sentenced to 2 years in FTX crypto scandal

(This story was updated to add new information.)

The fallout from a multi-billion dollar scam that bankrupted the cryptocurrency company FTX and plunged some markets into chaos two years ago continued Tuesday when former crypto executive Caroline Ellison was sentenced to 24 months in prison.

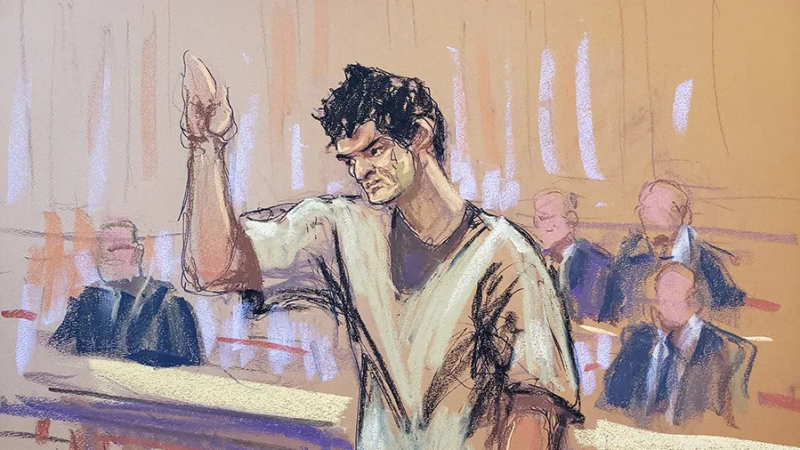

Ellison, the former chief executive of FTX's sister firm and crypto hedge fund Alameda Research turned romance novelist, has described herself as a remorseful participant in the fraud. Prosecutors said her cooperation helped convict FTX mastermind and her former boyfriend Sam Bankman-Fried in 2023.

The crimes Ellison pleaded guilty to carried a maximum sentence of 110 years.

"She cooperated, and he denied the whole thing," U.S. District Judge Lewis Kaplan said. "He went to trial, as was his right, and it didn't work out so well. The reason it didn't work out so well, in some significant part, is that Ms. Ellison cooperated."

The sentencing caps a confounding journey for Ellison, who cited philanthropic goals as she rose to prominence in the crypto world. In her testimony against Bankman-Fried, she described a chaotic environment where lying and stealing could be rationalized in the name of the greater good — and she expressed a sense of relief when it all came crashing down.

"Not a day goes by when I don't think about all the people I hurt," Ellison said in court. "My brain can't even truly comprehend the scale of the harms I've caused. That doesn't mean I don't try."

Who is Caroline Ellison?

A high-achieving student and daughter to an MIT economics professor and lecturer, Ellison grew up in Boston. She studied math at Stanford and embraced an “effective altruism” philosophy that encourages crunching numbers in order to determine which philanthropic donations best benefit society.

Also a child of academics and a participant in the effective altruism movement, Bankman-Fried met Ellison at a Wall Street trading firm when he was assigned to mentor her class of interns. Eventually, the pair dated on and off and she became involved in his once-revered cryptocurrency empire.

Ellison plead guilty to seven felony counts of fraud and conspiracy in the wake of the FTX scandal.

In March, Bankman-Fried was sentenced to 25 years in prison for stealing about $8 billion from customers of the now-bankrupt cryptocurrency exchange he founded. This month, Bankman-Fried filed an appeal seeking new proceedings with a new judge, claiming he was denied a fair trial last year.

What is the FTX fraud scandal?

FTX, short for "Futures Exchange," benefited from a boom in cryptocurrency prices during the COVID pandemic that led to Bankman-Fried achieving billionaire status, according to Forbes.

He rode that success until his company began to unravel and file for bankruptcy in 2022. The next year, a New York jury determined much of his empire was built on fraud.

Bankman-Fried was accused of improperly diverting FTX customer funds to Alameda Research, the hedge fund he founded and that Ellison ran from 2021-2022.

What was Ellison's role in the fraud scandal?

During Bankman-Fried's trial, Ellison told the jury he directed her to take money from unknowing FTX customers. In tearful testimony, she expressed remorse for her actions and said she felt "indescribably bad" about taking part in the fraud.

"I felt a sense of relief that I didn't have to lie anymore," Ellison testified.

Bankman-Fried's trial defense lawyer Mark Cohen in his closing argument accused Ellison of "pointing at Sam" to escape blame after the company's collapse.

Ellison's lawyers argued that she should receive no prison time due to her heavy cooperation with prosecutors. The Manhattan U.S. Attorney's office, which brought the charges, also made a case for leniency in a letter to the judge, citing her "extraordinary" help in convicting Bankman-Fried and her taking responsibility for wrongdoing.

Reuters contributed to this report. Reach Rachel Barber at rbarber@usatoday.com and follow her on Twitter, at @rachelbarber_

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.