Jury begins deliberating fate of FTX founder Sam Bankman-Fried

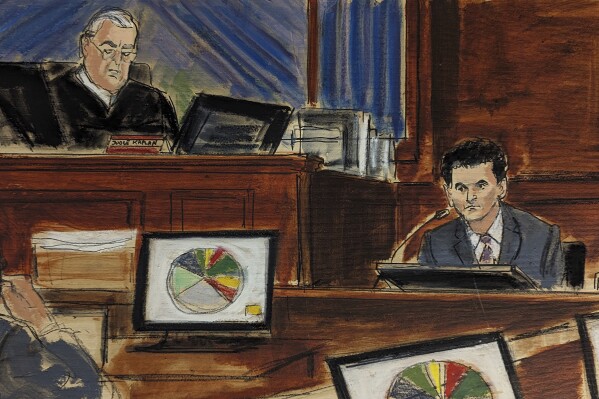

NEW YORK (AP) — A New York jury began deliberating on Thursday whether FTX founder Sam Bankman-Fried was guilty of fraud in the disappearance of billions of dollars from his customers’ accounts on the cryptocurrency exchange he created four years ago.

The Manhattan federal court jury began its work after a judge explained the law that will steer them through seven charges lodged against the California man.

Bankman-Fried, 31, testified during the monthlong trial that he did not defraud thousands of investors worldwide.

He was extradited to New York from the Bahamas last December to face fraud charges. He’s been jailed since August, when Judge Lewis A. Kaplan ruled that he’d tried to influence potential trial witnesses and could no longer remain free on the $250 million personal recognizance bond that required him to remain at his parents’ Palo Alto, California, home.

Prosecutor cites ‘pyramid of deceit’ by Sam Bankman-Fried; Defense lawyer says he’s no monster

Prosecutor cites ‘pyramid of deceit’ by Sam Bankman-Fried; Defense lawyer says he’s no monster

Closing arguments next in FTX founder Sam Bankman’s fraud trial after his testimony ends

Closing arguments next in FTX founder Sam Bankman’s fraud trial after his testimony ends

Actor Robert De Niro tells a jury in a lawsuit by his ex-assistant: ‘This is all nonsense’

Actor Robert De Niro tells a jury in a lawsuit by his ex-assistant: ‘This is all nonsense’

Earlier Thursday, Assistant U.S. Attorney Danielle Sassoon delivered a rebuttal argument, the last of closing arguments that began a day earlier.

She said Bankman-Fried repeatedly promised thousands of customers worldwide that the money they placed on the FTX exchange was safe and guarded even as he was stealing from them, always wanting “billions and billions of dollars more from his customers to spend on gaining influence and power.”

Sassoon, who cross examined Bankman-Fried late last week and early this week, said Bankman-Fried wanted to be U.S. president some day but first wanted to have the biggest cryptocurrency exchange in the world. At its peak, FTX was the second-largest.

She said he “dazzled investors and Congress and the media, and worked around the clock to build a successful business” while overseeing the stealing of FTX funds.

“He knew it was wrong, he lied about it and he took steps to hide it,” the prosecutor said.

On Wednesday, Bankman-Fried attorney Mark Cohen said in his closing argument that his client “may have moved too slowly” when it became clear that Alameda Research, a cryptocurrency fund he started in 2017, could not restore billions of dollars borrowed from FTX when customers demanded it.

“He may have hesitated,” Cohen said. “But he always thought that Alameda had sufficient assets on the exchange and off the exchange to cover all of its liabilities.”

He added: “Business decisions made in good faith are not grounds to convict.”

Cohen told jurors to recall Bankman-Fried’s testimony as they review evidence.

“When Sam testified before you, he told you the truth, the messy truth, that in the real world miscommunications happen, mistakes happen, delays happen,” Cohen said. “There were mistakes, there were failures of corporate controls in risk management, and there was bad judgment. That does not constitute a crime.”

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.